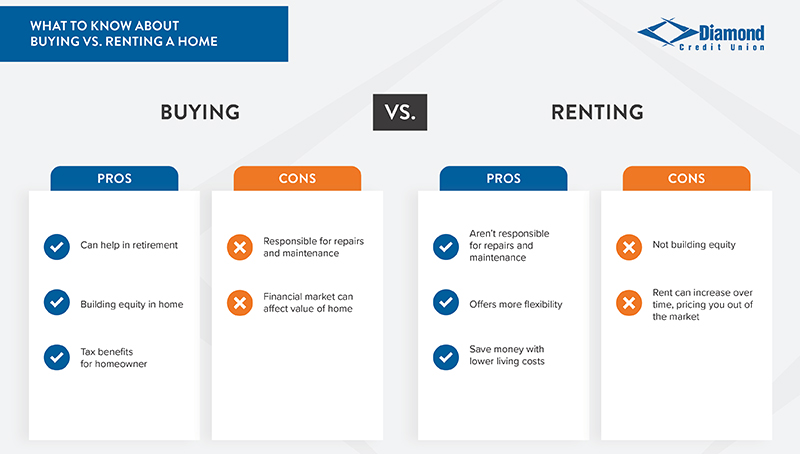

What to Know About Buying vs. Renting a Home

You’ve probably heard the old adage that buying a home is always a good investment and renting is “just throwing money away.” However, this isn’t necessarily true. The decision between buying vs. renting a home should be based on a thorough assessment and understanding of your financial situation. The choice you make will affect your lifestyle, accumulated savings, and how much you have leftover each month, so it can’t be taken lightly. In this blog, we’ll explore the pros and cons of buying a house and the pros and cons of renting a house to help you make the right decision.

Start By Thoroughly Assessing Your Financial Health

The choice between buying vs. renting a home starts with taking a serious look at your current financial situation. You should ask yourself the following questions:

- How large of a monthly payment can I afford?

- How long do I want to stay in my current geographic location?

- Do I want stability or flexibility?

- Can I afford potential home repairs and maintenance?

- What are my current and long-term financial, career, and personal goals?

Experts recommend only purchasing a home if you can afford at least a 10% down payment and cover all closing costs. You should also have 3-6 months worth of expenses in your emergency fund for unexpected repairs and maintenance

Reasons to Consider Buying a Home

There are many compelling reasons to purchase a home. Let’s take a closer look at the pros and cons of buying a house to help you decide what’s right for you.

Mortgage Payments Are Relatively Stable

If you get a fixed-rate mortgage, your principal and interest are the same for the length of the loan. Your school and property taxes and homeowners insurance premiums may rise, but not significantly. That means your monthly payments will be relatively static. When you rent, there’s a chance your payment may increase each time you renew your lease.

Your Home Is an Appreciating Asset

When you rent, you’re essentially an income stream for your landlord. There’s no long-term benefit on your end. When you own a home, though, you consistently build equity over a sustained period. And as your equity increases, more of your monthly payment goes towards your principal, rather than just interest. Plus, if the value of your home increases while you own it, you’ll make a profit when you sell. There are also tax benefits to owning a home if you itemize your deductions.

You Can Make Your Home Your Own

As a homeowner, you’ll be able to make improvements and upgrades to match your taste with no landlord to answer to. In most cases, any customizations and renovations you make will boost your home’s value, which will benefit you when you eventually sell.

Homeownership Can Benefit You in Retirement

If you’re like most people, your monthly income will decrease after you retire. But if you buy a home and pay off your mortgage by the time you retire, you’ll only owe taxes and insurance, which will almost always be less than rent. Plus, you can tap into your home equity for things like debt consolidation, home improvements, and emergency expenses.

Reasons to Consider Renting a Home or Apartment

Many people who consider renting ask the question, “is renting a waste of money?” While buying a home is the right choice for some people, there are also plenty of good reasons to consider renting. We’ll explore the pros and cons of renting a house in more detail below.

Renting May Be Cheaper Depending on Where You Live

It’s cheaper to rent than buy in nearly 60% of U.S. housing markets, especially in and around busy metropolitan areas. If you live in a particularly expensive area, renting may be the most affordable option.

Don’t make direct comparisons of monthly mortgage payments and rent amounts. Instead, use an online home affordability calculator to help you decide whether it’s better to rent or buy in your area.

Your Overall Costs Are Typically Higher When You Own

It’s important to remember the additional costs associated with homeownership, as opposed to renting. You’ll be responsible for things like:

- Property taxes

- Homeowners insurance

- Home repairs and maintenance

- Condo / HOA fees (if applicable)

- Closing costs

With the right preparation and planning, these items can easily be worked into your budget. But it’s crucial to seriously consider them when you’re deciding between buying vs. renting a home.

You Aren’t Responsible for Repairs & Maintenance

Another benefit of renting is not being responsible for unexpected repairs and maintenance. Big ticket expenses can add up quickly, which is a negative for some buyers. But when you rent, you have a more accurate idea of what you’ll spend on housing each month. That also means more time for yourself since you aren’t busy with home projects.

Renting Offers More Flexibility

If you’re not sure where you’ll be living in five years or what your life will look like, you should probably rent. You won’t be locked into a multi-year mortgage, leaving you with more flexibility to figure things out. Plus, it can be difficult to sell your home during a down housing market, which limits your options if you want or need to move.

The convenience of renting is ideal for people who like to travel for extended periods of time or who relocate frequently for work. If you’re going through a major life change (e.g. marriage, divorce, or having a child), you may also want to consider renting.

Renting Can Help You Save Money to Buy a Home

Interested in purchasing a home in the future but aren’t on stable financial footing at the moment? Renting can be a great way to save up money for a down payment and closing costs. You can also use your time as a renter to pay off student loans or credit card debt, making you a more appealing homebuyer.

If you’re ready to buy a home and are wondering “how much house can I afford?”, we’d love to help. Get started by visiting our Mortgage Center and connecting with our team of experts today!