How Long It Takes to Build Equity in Your Home, and When You Should Sell

Buying a home is one of the most significant financial investments most people make. One of the key benefits of homeownership is the chance to build equity, which represents the portion of your home that you truly own. Equity grows over time as you pay down your mortgage and as your home’s value increases. But how long does it take to build, and how long should you wait before selling your home? Let’s break it down.

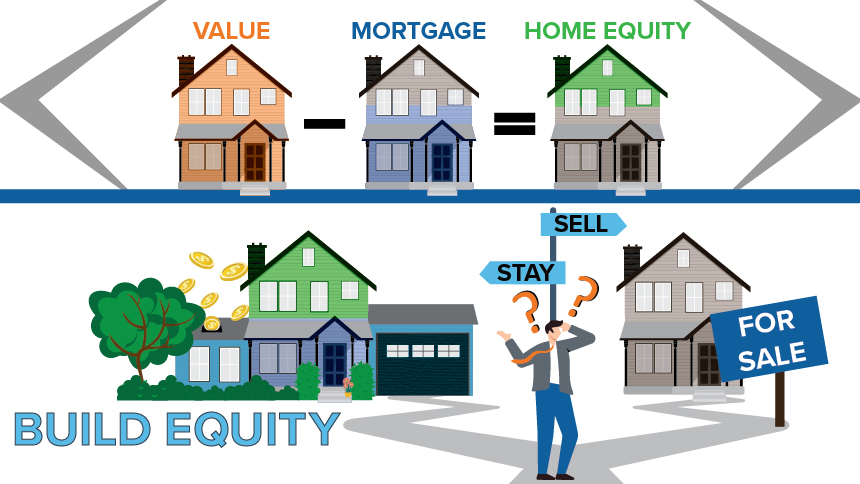

Understanding Home Equity

Equity is the difference between your home’s market value and the amount you still owe on your mortgage. For example, if your home is worth $300,000 and you owe $200,000, you have $100,000 in equity.

Your equity grows in two primary ways:

- Paying Down Your Mortgage – Each mortgage payment reduces the principal balance, increasing your ownership stake.

- Home Appreciation – If your home’s value increases due to market conditions or home improvements, your equity also rises.

How Long It Takes to Build Equity

It takes time to build equity, but the rate at which it grows depends on several factors.

1. Your Down Payment

The larger your down payment, the more immediate equity you have. If you put 20% down on a $300,000 home ($60,000), you start with $60,000 in equity. If you only put down 5% ($15,000), you’ll start with less.

2. Mortgage Payments

In the early years of a mortgage, most of your monthly payment goes toward interest rather than principal. This is because of the way mortgage amortization works—early on, a larger portion of the payment covers interest, while later payments contribute more toward the loan balance.

For example, with a 30-year fixed mortgage at 6%, it may take 5-7 years before your payments start making a significant impact on the principal. This means that in the first few years, your equity grows slowly unless home values rise.

3. Home Appreciation

On average, home values appreciate 3-5% per year. However, appreciation depends on market conditions, location and economic factors. Some homeowners see faster gains in hot markets, while others may experience slower growth or even temporary declines.

4. Additional Payments

If you make extra payments toward your principal, you can build equity faster.

When Should You Sell Your Home?

While there’s no universal timeline for selling a home, there are several factors to consider before making the decision.

1. The Five-Year Rule

A common rule of thumb is to wait at least five years before selling. This allows time to build equity and offset the costs of buying and selling, such as:

- Closing costs – typically 2-5% of the home’s price

- Realtor commissions – 5-6% of the sale price

- Moving expenses and potential home repairs

If you sell too soon, you may not have enough equity to cover these costs without taking a financial loss.

2. Market Conditions

Before selling, consider the local real estate market. A seller’s market, where demand is high and inventory is low, may allow you to sell at a higher price and maximize gains. In a buyer’s market, selling too soon may mean lower offers and reduced profits.

3. Loan Payoff Considerations

If you sell before building enough equity, you might not walk away with much cash after paying off your mortgage. In some cases, if your home’s value has dropped, you could owe more than it’s worth, making it difficult to sell without financial loss.

4. Capital Gains Taxes

If you sell your home for a profit, you may be subject to capital gains tax. However, if you’ve lived in your home for at least two of the past five years, you can exclude up to $250,000 in gains, or $500,000 for married couples, from taxes. Selling too soon may mean paying taxes on your profits.

5. Life Changes

Sometimes, personal circumstances dictate when you sell. Job relocations, family changes, or financial shifts may require selling earlier than planned. If this is the case, running the numbers on your equity, selling costs, and market conditions can help you decide if now is the right time.

How to Build Equity Faster Before Selling

If you’re planning to sell and want to maximize your profit, consider these strategies:

- Make extra mortgage payments – Even one additional payment per year can reduce your loan balance significantly over time.

- Increase your home’s value – Strategic renovations, such as kitchen or bathroom upgrades, can boost your home’s resale price.

- Refinance for a shorter loan term – A 15-year mortgage builds equity faster than a 30-year loan, though payments will be higher.

- Wait for market appreciation – If you’re in a strong housing market, simply staying put for a few more years could significantly increase your equity.

The best time to sell depends on your financial situation, home equity and market conditions. While waiting at least five years is ideal for most homeowners, it’s essential to evaluate your specific circumstances.

If you have enough equity to cover selling costs and still make a profit, and market conditions are favorable, selling could be a great move. However, if you’re still early in your mortgage or market conditions are poor, waiting a little longer might be the smarter financial decision.

By understanding how equity builds and making strategic choices, you can ensure that when the time comes to sell, you’re in the best position to benefit from your investment.