So you’re about to move in with your significant other? Managing finances with cohabiters is an important discussion to have. The thought of setting up a house together can be incredibly exciting. Perhaps you have already weighed the pros and cons of your decision, but have you thought through the financial impact that your living arrangement can produce? Before taking that next big step, it is essential to protect yourself financially in case there are any unexpected hiccups along the way.

Challenges that May Arise

The fact of the matter is, you spend the majority of your free time together so why not live together? Bills would be split 50/50, allowing both of you to save money at the end of each month. While this sounds good in theory, couples often have a difficult time seeing eye to eye on the best way to spend and save their shared income. In fact, this is the number one reason why couples argue.

The fact of the matter is, you spend the majority of your free time together so why not live together? Bills would be split 50/50, allowing both of you to save money at the end of each month. While this sounds good in theory, couples often have a difficult time seeing eye to eye on the best way to spend and save their shared income. In fact, this is the number one reason why couples argue.

Here is some advice on handling the challenges that may arise in your new living arrangement.

Sharing Expenses

It wouldn’t be uncommon if you and your significant other earned different levels of income. When it comes to splitting the living expenses down the middle, this may not be possible. You may need to rework your plan so that the partner who makes 60% of shared income, takes ownership of 60% of the expenses.

Have Extra Savings

While moving in together is an exciting step in your relationship, there are some things you might want to keep separate for now; like your checking and saving accounts, and lines of credit.

Separate funds can also come in handy if you ever need to cover your partner’s share of the expenses. An emergency fund can carry you forward without being brought down by a partner who could potentially ruin your credit.

A Little Proactive Planning Goes a Long Way

The best way to counteract any possible challenges is to plan, plan, plan! Covering all your bases will go a long way, especially when your hard-earned dollars are involved.

The best way to counteract any possible challenges is to plan, plan, plan! Covering all your bases will go a long way, especially when your hard-earned dollars are involved.

Discuss Finances Before Signing a Lease

Before moving in together, it might be time to have crucial discussions about money. Dig deep and find out as much as you can about your partner’s financial picture. This includes salary, monthly expenses, current debt, and credit score.

Next, nail down how you will handle paying for living expenses such as:

• Housing

• Food

• Utilities, including phone and internet

Beyond the Bills

You might feel that you and your significant other are “two peas in a pod,” but after weeks of living together, you may start to notice some differences in your lifestyles…or at least your spending habits. Finances are never easy to discuss, but it’s best to know each other’s opinions early.

Gift giving. You may like to buy gifts all year long for family and friends’ birthdays or holidays. Do they? If you have a combined budget, you need to agree on how much will be spent on gifts.

Entertainment. The movies, dining out, and concerts or plays and all add up rather quickly. Is your combined budget able to take a hit of $50, $100, or more for just one night for the both of you? How often can you afford to go out?

Vacations. When you start to plan your vacation, set a budget to include everything you can think of including taxis, tipping, and souvenirs. A day trip to the local amusement park sounds inexpensive – admission and parking. What about food and drinks? A locker for extra gear or to store your clothes while you swim if it’s a water park? Stroller rental? Do your homework and don’t forget the little stuff.

Communication Is Key!

Couples that partner together and discuss their finances are better equipped to meet their long-term goals and are less likely to bicker about money. If you have found your happy place, don’t let that ball drop! Keep the lines of communication open by having monthly conversations about bills and financial goals as a couple.

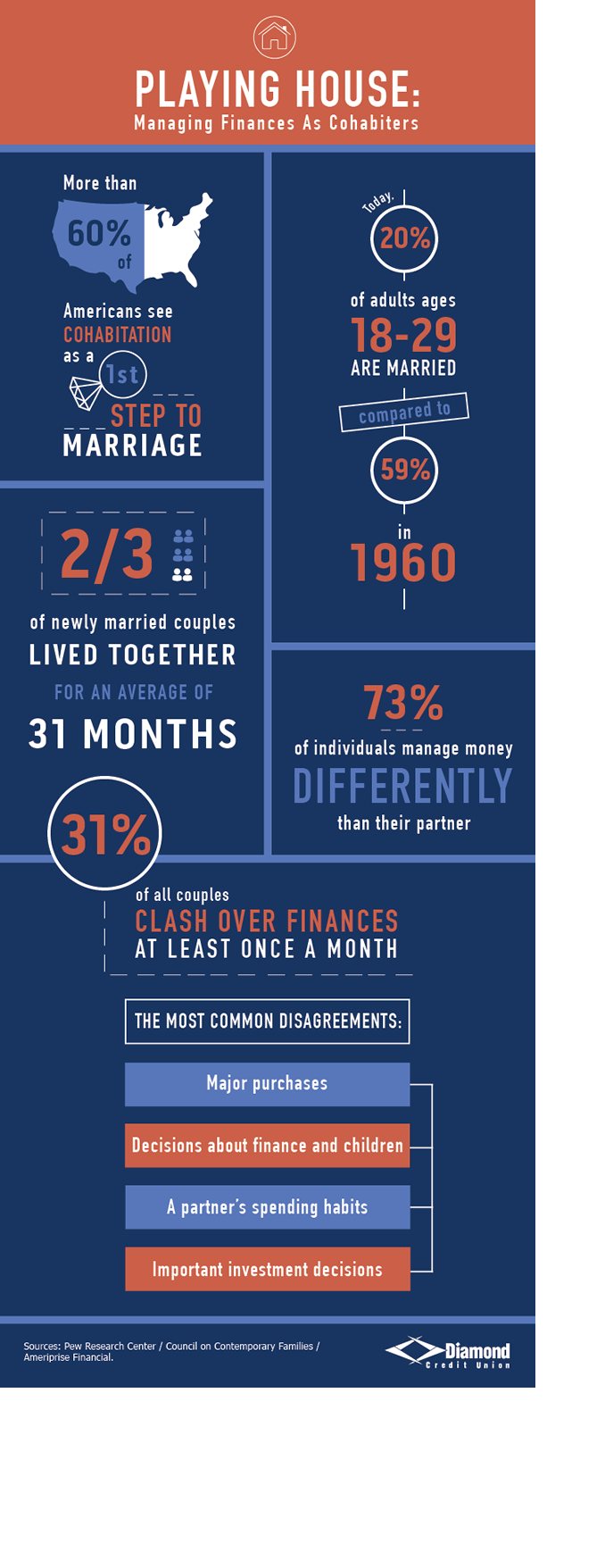

The following infographic shows some statistics of today’s cohabiters: