Navigating Financial Decisions in a Relationship: A Guide to Building Trust & Stability

Money and making financial decisions in a relationship can be one of the most challenging topics, yet it’s a crucial aspect of building a life together. Financial decisions in a relationship affect everything from daily expenses to long-term goals like homeownership, children, and retirement. Successfully managing these choices requires open communication, trust, and a willingness to compromise. Here are key strategies to ensure financial harmony in your relationship.

1. Start with Open Communication

Before making significant financial decisions in a relationship, couples need to have honest conversations about money. This includes discussing income, debts, spending habits, and savings goals. Transparency is key; hiding financial struggles or overspending can erode trust. Schedule regular financial check-ins where you both share your concerns and ideas.

A great way to start is by discussing your financial values. Does one partner prioritize saving for retirement while the other prefers spending on experiences? Understanding each other’s perspectives can help prevent conflicts and create a plan that reflects both partners’ priorities.

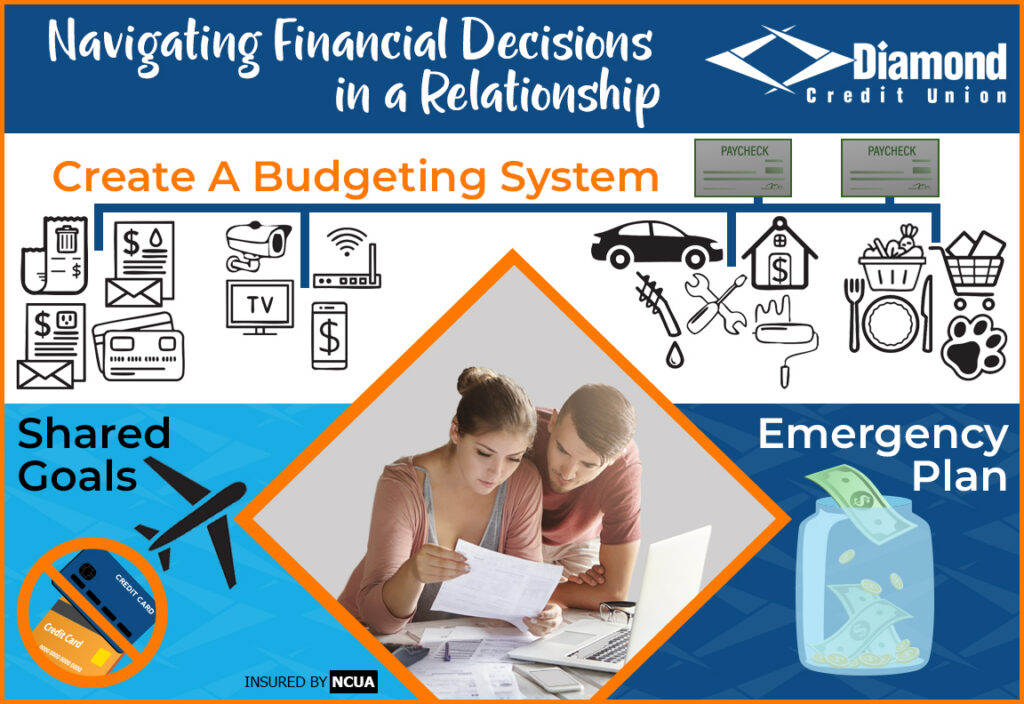

2. Set Shared Goals

Couples who align on financial goals tend to navigate challenges more smoothly. Discuss short-term objectives, such as saving for a vacation, and long-term aspirations, like buying a home or planning for retirement. Once you’ve identified your goals, create a roadmap for achieving them.

For example, if you want to save for a down payment on a house, decide together how much to save each month and where to cut back on spending. Having clear goals keeps both partners accountable and motivated.

3. Decide on a Budgeting System

How you manage day-to-day finances is a personal decision, but it’s important to agree on a system that works for both partners. Some couples combine all their finances, while others prefer to keep separate accounts and contribute to joint expenses proportionally.

Regardless of the system, a shared budget is essential. This budget should outline how much each person contributes to essentials like rent, groceries, and utilities, while also allowing for individual spending.

4. Plan for Emergencies

Life is unpredictable, and financial emergencies can strain even the strongest relationships. Build an emergency fund with at least three to six months’ worth of living expenses. Agreeing on a plan for unexpected situations—like job loss, medical bills, or car repairs—can provide peace of mind and prevent panic-driven decisions.

5. Respect Differences

No two people have identical financial habits or histories. One partner might be a natural saver, while the other is more inclined to spend. Instead of letting these differences cause friction, view them as opportunities to balance each other out.

For instance, a spender might introduce the saver to the joys of occasional splurging, while the saver can encourage responsible budgeting. Mutual respect and compromise are essential.

6. Seek Professional Advice if Needed

If financial conflicts persist or you’re unsure how to plan for big goals, consider consulting a financial representative. A neutral third party can offer guidance tailored to your situation and help you both feel more confident in your decisions.

Making financial decisions in a relationship isn’t just about money; it’s about trust, communication, and shared values. By being open, setting clear goals, and respecting each other’s perspectives, couples can build a financial foundation that supports both their dreams and their relationship. Working together ensures that money becomes a tool for growth rather than a source of conflict.