As students head off to school this fall, they need to stay vigilant against the scams, schemes and tricks of identity fraudsters. Student identity theft is on the rise, all around the world and it is not something you want to learn at college.

Like most predators, identity thieves like to target the young and the elderly. That’s why college and university students frequently become victims of identity theft. Consider these statistics:

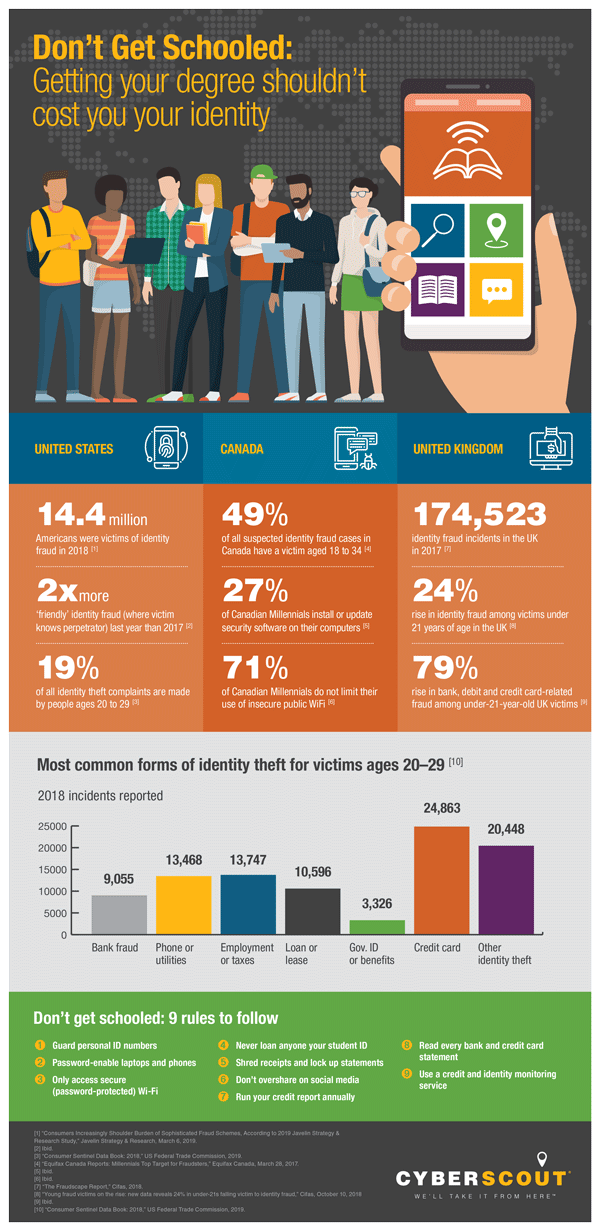

- 49% of all suspected identity fraud cases in Canada have a victim aged 18 to 34. (1)

- There’s been a 24% rise in identity fraud among UK victims under 21 years of age. (2)

- 19% of all identity theft complaints in America are made by people ages 20 to 29. (3)

Students make ideal victims for fraudsters

There are several reasons why students are so often targeted by identity thieves. First, they tend to be less guarded and cautious with personal information, so it is easier to gather the necessary data points. Second, they are often less vigilant about preventative security measure, like pulling credit reports and safe browsing and social media. A recent survey in Canada revealed that Millennials scored the lowest among all age groups at taking preventative measures against identity theft and fraud. (4)

Students also fill out forms and applications continuously, for everything from student aid and loans, to housing, credit cards and jobs. They can often be duped into filling out information for a company or club that isn’t legit. Finally, most students have a limited credit history, and businesses want to form credit relationships with them. Assuming a student’s identity often makes it easy for fraudsters to obtain loans or credit cards.

Inexperience can lead to misplaced trust

For many young adults, college or university is their first extended stay away from home. They lack the experience with flim flam and con artists that their parents have gained over a lifetime of adulting. It therefore is not surprising that students tend to put their trust in people too quickly and overshare personal information while making new friends. This can be disastrous.

Today, ‘friendly fraud’ — where the victim knows the perpetrator — accounts for 15% of all fraud committed. (5) In cases of identity theft where the fraudster opens a new account, more than half of victims know the thief! (6) It’s best to be reserved about personal details when getting to know new roommates, friends or love interests.

Identity theft takes many forms

Beyond credit cards and bank accounts, identity theft can be used to obtain fraudulent IDs, takeover mobile phone accounts, steal utilities, obtain mortgages or rental leases, get a job, or steal your tax refund. You name it and identity thieves have probably figured out a way to rip it off. For victims ages 20 to 29, the most reported types of identity theft are:

- 26% credit card

- 21% other identity theft

- 14% employment or tax

- 14% phone or utilities

- 11% loan or lease

- 9% bank

- 3% government ID or benefits

Dramatic increases in two types of fraud have been noted by researchers. Among under-21 victims in the UK, there has been a 79% rise in bank, debit and credit card related fraud. (7) Meanwhile, in the US, mobile phone account takeovers nearly doubled in one year, from 380,000 incidents in 2017 to almost 680,000 victims in 2018. (8)

Talk to students about the dangers

Share the facts in this article with students you know and encourage them to be extra vigilant when they go off to college. With the right knowledge and cyber defense solutions, students don’t have to become victims of identity theft.

Diamond Credit Union has partnered with CyberScout to offer comprehensive identity management services. If you detect suspicious activity or would like to proactively protect your identity, contact us at 610-326-5490 to be connected to a CyberScout fraud expert.

(1)“Equifax Canada Reports: Millennials Top Target for Fraudsters,” Equifax Canada, March 28, 2017.

(2)“Young fraud victims on the rise: new data reveals 24% in under-21s falling victim to identity fraud,” Cifas, October 10, 2018.

(3)“Consumer Sentinel Data Book: 2018,” US Federal Trade Commission, 2019.

(4)“Equifax Canada Reports: Millennials Top Target for Fraudsters,” Equifax Canada, March 28, 2017.

(5)Ibid.

(6)Ibid.

(7)“Young fraud victims on the rise: new data reveals 24% in under-21s falling victim to identity fraud,” Cifas, October 10, 2018.

(8)Ibid.