Here’s a secret way to keep your identity—and that of your loved ones—secure: Never share your Social Security number unless it’s absolutely required.

That’s right. Most of the time, it’s OK to say no to schools, doctor’s offices, sports clubs and many other organizations that may ask for this nine-digit identifier. In fact, safeguarding SSNs is a key first step to protecting against identity theft and other fraud.

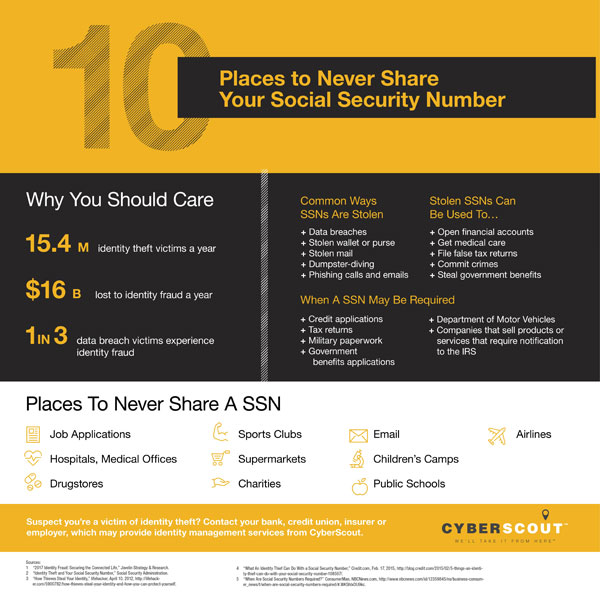

Identity theft continues to afflict consumers in the United States. More than 15 million people fall victim to this crime and about $16 billion is lost to it in a year, according to Javelin Strategy & Research. Stolen SSNs make it easy for criminals to commit identity fraud. With them, they can open new lines of credit and accounts, file fraudulent tax returns, secure medical care and steal government benefits.

“For better or worse, you are the gatekeeper,” said Adam Levin, chairman and founder of CyberScout. “The person most responsible for shielding your Social Security Number is you. Therefore, your mission is to limit, as best you can, the universe of those who gain access to it.”

Here are 10 places that have no business asking for a SSN:

- Job applications

- Hospitals or medical and dental offices

- Pharmacies

- Public schools

- Sports clubs

- Children’s camps

- Supermarket loyalty programs

- Charities

- Airline ticketing and frequent flyer programs

- Email messages

Unsure how to respond when someone asks for this number? It’s important to never hand it over blindly, Levin said. He recommends following these steps when determining how to react:

- Stop and think. Take a moment to consider if there is a legitimate need for the SSN. Many places blindly ask for it, but some places, such as the IRS, Department of Motor Vehicles or military, may legitimately need it.

- Negotiate. There are other identifiers, such as a driver’s license or account number, that maybe used instead. Fight to use them.

- Get assurance. If you must share your SSN, make sure there are strong security measures in place to protect it.

For more information about how to protect your good name and credit, visit The Fraud Report page at Diamond Credit Union for identity theft safety tips. Knowledge is the first step in prevention.

Content and infographic provided by CyberScout.