Saving for and paying for college can be an 18+ year endeavor, and many families are uncertain about how to build their child’s college savings the right way.

With the price of a college education rising each year, parents may wonder what their savings goal should be. Their very first question is often, “what will tuition cost when my child attends college?” So, let’s start there.

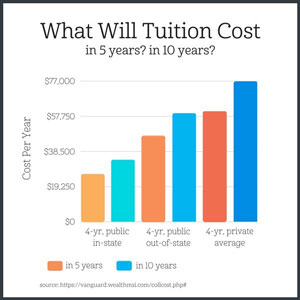

To get an idea of the price tag you may be facing, here are estimated tuition rates for different types of education over the next few years:

Thankfully, a national average of only 12% of college freshman end up paying full price for their college education. But, even with a reduced price of admission, building a college savings as soon as possible is essential. The further ahead you plan, the more favorable your options will be and the less daunting the cost impact will seem.

Thankfully, a national average of only 12% of college freshman end up paying full price for their college education. But, even with a reduced price of admission, building a college savings as soon as possible is essential. The further ahead you plan, the more favorable your options will be and the less daunting the cost impact will seem.

The good news is you don’t need to have 100% of the cost of college saved by the day your child receives their acceptance letter. College is paid for with a combination of current income, accumulated savings, financial aid (scholarships, grants, etc.), and loans. So, how much should you have in your child’s college savings to feel like you’re on the right track? Follow this widely-used rule of thumb:

$2,000 x Your Child’s Age = Your Current College Savings

Whether you’ve got a head start or need a jump start, follow these three steps to put your family in a good position when it comes time to pay for your child’s education:

1. The Best Ways to Save for Your Child’s College Education

Set up and start contributing to your child’s college savings fund as early as you can. With $50 per month over 18 years, you can save approx. $20,000 (earning 6% per year). That’s the equivalent of skipping the restaurant and cooking a family dinner at home, just once a month.

In recent years, tax-advantage saving plans have been gaining popularity as a way to save for college. With these savings plans, contributions are not tax deductible, but the account grows tax-free and withdrawals are not taxed as income if they are used to pay for qualified educational expenses.

Here are the most popular tax-advantage college savings plans:

529 Savings Plans

Nearly every state offers a 529 savings plan. The state you live in and the state in which your student eventually attends college has no effect on the state plan you choose. You can live in PA, chose a plan from IA, and your child can attend school in MA.

Coverdell Savings Account

In addition to higher education costs, money in Coverdell accounts can also be used for education expenses for your child’s K-12 education.

Roth IRA

Typically, you must be 59 1/2 years old to withdraw from a Roth IRA account without penalty. Early withdrawals (before you turn 59 1/2) are allowed, but only if they are used to pay for college expenses and you’ve had the account for more than five years. Any savings that are not spent on college will remain in your account for use when you retire.

2. What You Should Know About Applying for Financial Aid

A college savings fund is an important first step in preparing for your child’s higher education, but financial aid will lessen the impact of the cost of college for many families.

Start with FAFSA

To apply for need-based financial aid, you must submit a Free Application for Federal Student Aid (FAFSA) application. With one form, a student can apply for federal student aid, as well as financial aid through the schools they’ve applied to / have been accepted to.

FAFSA forms should be completed beginning in October of a student’s senior year of high school (and will need to be completed each year for the following school year as long as they plan to attend college). If your student is still applying to schools, list each school they’ve applied to on the FAFSA form so the schools can complete a financial aid offering.

Financial Aid Package

Along with a student’s acceptance letter, schools will typically include the financial aid package they are offering the student. Your financial aid package can include scholarships, grants, or work-study offerings from each school, as well as applicable federal grants and federal student loans. Aid from scholarships, grants, and work-study programs do not need to be repaid.

In addition to federal financial aid, you should also research private scholarship and grant programs available nationwide or often there are many found locally. Look into aid options that line up with your student’s extracurricular activities, service projects, or area of intended study.

3. Understanding Student Loan Options

As mentioned above, most financial aid packages will include federal student loan options. Some students and parents are wary of taking on student loan debt, but in small amounts and at lower interest-rates, student loans can be a smart tool for building a personal credit history.

The most common types of federal student loans available include:

Direct Subsidized Loans

These loans are available to students who demonstrate financial need. Currently, the maximum annual reward is $5,500 and there is no interest charged on the loan until repayment begins at six months after a student leaves school.

Direct Unsubsidized Loans

Students do not have to demonstrate financial need when applying for these loans, and the current maximum annual award is $20,500. With an unsubsidized loan, interest will be charged on the loan from the start.

Direct PLUS/Parent PLUS

When financial aid and federal student loans are not enough to cover the total cost of college, parents may be able to use a federal Parent PLUS loan to fill the gap if they qualify.

Be sure to take advantage of all federal loan options before looking into private loans to pay for college. Unlike private loans, federal loans offer these helpful benefits:

- Delayed repayment of the loan until after graduation

- Lower, fixed interest rates

- Interest may be tax-deductible

- Options to defer loan repayment or lower payments are available in times of hardship

- Several repayment options are available to suit various financial situations

- Opportunities for loan forgiveness are available

For more information about all federal student loan options, visit Federal Student Aid.

If your college savings, scholarship/grant aid, and federal student loans don’t completely cover the necessary costs, you might also explore the option of private student loans. For example, Diamond Credit Union partners with Sallie Mae on a Smart Option Student Loan. There are other private loan options available to credit union members.

Building your child’s college savings and helping your student make smart money choices on campus are important.

MORE FINANCIAL TIPS FOR GOING TO COLLEGE