You’ve heard of 0% APR car loans, but what does 0% financing mean?

In the past, 0% interest offers typically reached their height during the summer to encourage sales of the outgoing model year. However, 0% interest auto loans and aggressive dealer rebates have become increasingly prevalent due to the COVID-19 pandemic.

If you’re looking for more information about how to get a 0% APR car loan, you’ve come to the right place. In this blog, we’ll take a closer look at what you should know about 0% interest auto loans so you can make an informed decision at the dealership.

Always Do Your Research Beforehand

It’s extremely important to crunch the numbers and get the lay of the land before you walk into the dealership. Be sure to get pre-approved for a traditional auto loan, which can act as leverage or a fallback option if you don’t qualify for 0% financing.

You should always shop around to compare different manufacturers before you make your decision. Automakers may have leftover inventory of 2020 models they’re looking to move, making it easier to negotiate a price. You can search a manufacturer’s website directly to see which models qualify for 0% interest, so you’re armed with the facts when speaking with a salesperson.

If you were planning on paying in cash, you may still want to consider a 0% interest loan if you qualify. This keeps your money freed up for other purposes, like an emergency fund or retirement. Finally, make sure you have enough for a solid down payment (20% is preferable) to ensure you don’t go underwater on your 0% APR car loan.

You’ll Need a Strong Credit History to Qualify

In many cases, 0% interest auto loans may only be available to individuals with very strong credit histories. You’ll probably need a “very good” or “exceptional” FICO® score, which is typically 740+. Credit ranges vary among manufacturers and dealers, but many say you’ll need “Tier One credit” to qualify for a 0% interest loan. If you’re not sure of your credit health, you can get a free report from AnnualCreditReport.com.

They’re Financed By Automakers

Unlike traditional auto loans — which are financed by credit unions and banks — 0% APR car loans are originated by so-called “captive finance companies.” These are the lending arms of automakers, and each manufacturer has its own captive lender. If a particular model isn’t selling as quickly as the manufacturer would like, captive finance companies offer 0% interest loans to entice shoppers.

Repayment Terms Are Typically Much Shorter

Zero-percent interest auto loans usually come with shorter repayment terms than traditional loans. This is one of the biggest benefits of 0% interest loans, since you can drive a car you still love with fewer monthly payments. You’ll also pay less interest over the life of the loan, and your car won’t have depreciated as much when you own it free and clear. Paying your car off more quickly also leaves you with more money to pursue your other financial objectives. It’s a good idea to review your finances before making any big purchase to ensure the new payment will fit within your budget.

Dealer Rebates Might Save You More Money

In most cases, dealers will offer you a rebate incentive in place of the 0% APR offer. While 0% financing can be very appealing, it’s almost always better to take the rebate. This is especially true if you don’t plan to keep the car for the full length of the loan term.

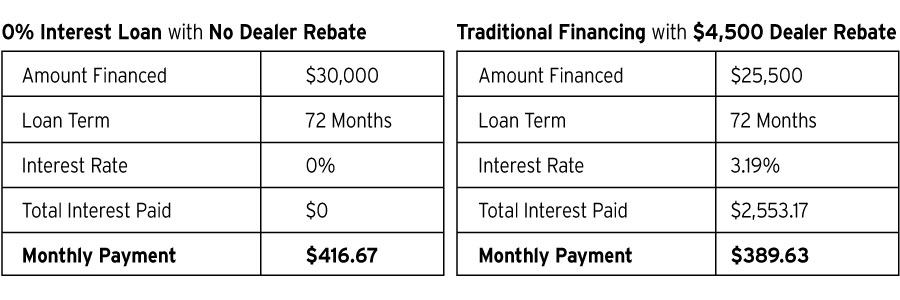

To illustrate this further, we’ve created an example that compares a 0% interest auto loan versus traditional financing with a dealer rebate:

As you can see, in this case, taking the dealer rebate results in a significantly lower monthly payment than a 0% APR car loan.