Budgeting Digitally Is Easy

When you think of a financial institution, many things might come to mind. Do you view it as where you deposit your paychecks? Maybe you see it as where you make your loan payments. When you bank with Diamond Credit Union, you can look at your banking experience in an entirely new way. As a Diamond member, you have access to resources for every stage of your financial journey. That’s why you can think of it as more than where you keep your money. Think of it as an opportunity. One of the opportunities that Diamond provides members with is a budgeting tool accessible right through NetBranch.

You can easily budget using online or mobile banking, by opening Diamond’s Club Accounts. You can open as many as you need and rename them for whatever you plan to use them for. Keep reading for ideas and steps to take to open these budgeting accounts.

For easy, on-the-go account management, download the Diamond App.

Club Accounts

You might have heard of a vacation or holiday club account. You may have even noticed that Diamond offers these. While many assume you must use these accounts for vacations or the holidays, they can be used for much more.

Another misconception you might have about these club accounts is that once you make a deposit, you have to wait a certain amount of time before you can access the funds. Unfortunately, emergencies arise and sometimes the money you save has to be used for more urgent matters. With Diamond, you have access to these funds at any time, so you don’t have to worry if you need the funds earlier than expected.

Other traditional club accounts may leave you with fees or loss of interest if you withdraw early. Another benefit to opening a club account with Diamond is that there are no fees, and you earn the same monthly interest from the start.

Personal Savings

Now that some of the common misconceptions are out of the way, try and view these accounts as more of a personal savings rather than club accounts. You might have some predispositions when it comes to savings accounts as well, but remember, think of these as an opportunity.

Some common uses for savings accounts include purchasing a house or car, retirement, etc. There are other things you could be saving for to make expenses throughout the year go a little smoother. You can use savings accounts for much more than long-term goals. You can use them as a budgeting tool.

Using Personal Savings Accounts to Budget

As mentioned above, common uses for savings accounts are usually for things that are far down the line. With Diamond’s club accounts, you can start saving for things that are happening right now and make budgeting a breeze. Here are some examples of how you can use these accounts to budget.

If you’re a homeowner, you can expect that every year you have to either fertilize your lawn yourself or pay someone else to. You also have to keep up with weekly mowing and yard work. You know it will cost you around $200 to get your lawn treated, and an additional $30 a week to have it mowed. If you’re paying $30 a week for four months/16 weeks, that equals $480. Add the initial cost of lawn care and that’s $680.

Instead of having to worry about dishing out $680 in four months, you can start putting money away every paycheck when you use a personal savings account. You can easily open either a holiday or vacation club account via NetBranch. A cool feature is that you can rename these accounts for what they are for. Since you want to put money aside for lawn care next summer, call this account “Lawn Care.”

Now it’s October and you want to prepare for next year’s lawn care. You spent $680 this past summer, so you want to put aside $700. There are 26 weeks between October 1 and next April. You know you will be paid 13 times between then. If you set aside about $54 every paycheck, you will have all $700 by the time you’re ready to start taking care of your lawn come spring. Now you’re splitting up that money over seven months instead of four. That means more money for vacation or other expenses in the summer.

If you do all your yard work yourself, it doesn’t hurt to keep some money in a savings in case you have any mower problems. If your lawn mower happens to break and you have to pay $1,000 for a new mower, you will be glad you set up that account back in October.

Here are some other examples of things you can utilize these accounts for.

If you have a gym membership, they can get pretty expensive. Create a club account and rename it to “Gym Membership.” Instead of having $50 come out of one paycheck, you can set aside $25 every two weeks. If you have a contract with your gym and it’s $200 a year, you can also create a savings to pay for your contract. You would only need to set aside less than $8 per paycheck. That sounds much better than $200 coming out of one pay period.

Maybe your hair appointment can get a little pricey, especially if you’re getting the full treatment. If your hair costs you $250 every three months, that is a lot coming out of your account at once. Try opening a club account and calling it, “Hair Appointment.” If you deposit $42 every two weeks, you will have a little over $250 ready to go in three months.

With a name like, “Holiday Club,” it’s easy for your mind to go straight to December and the holiday season. However, there are other occasions throughout the year when you might be buying gifts. What if your significant other’s birthday is within the same pay period as your best friend and your cousin? Buying gifts for three people at once adds up quickly. When you have bills to pay it can be even more daunting.

Set up a “Gift” account for occasions like this. Then you can deposit whatever is a reasonable amount for you every paycheck. If you set aside $25 every two weeks, that’s $600 in a year. Now you don’t have to worry about these purchases when the time comes because it’s already set aside.

Keep in mind, when you are ready to use the money you deposited, you can easily access it. All you have to do is transfer it from your savings into your checking, or withdraw from the account at the nearest Diamond branch.

There are so many opportunities for you to manage your money by using these accounts. You could even open an account for each bill you have to help you with budgeting. This would help you avoid spending money that is meant for expenses.

When you set money aside for future expenditures, you’re setting yourself up for financial success. These accounts provide you with an opportunity to be more financially stable, why not take advantage of them?

Budgeting During Inflation

Keeping track of your money and spending habits is especially important during times of inflation. When you’re taking in the same amount of money, but the costs of goods are rising, you may need to allocate your funds differently. If you use Personal Savings Accounts to budget, it can help you see what you’re spending your money on, as well as what you need to put more money toward.

Reviewing your expenses is essential when developing and adjusting your budget. Once you look over your expenses, which are everything from groceries, housing payments, bills, fun purchases, and more, you can work towards adjusting your budget for inflation. You should consider what purchases are necessities, and what you don’t necessarily need to buy.

While it isn’t fun to limit yourself on going out to eat, purchasing new clothes that you don’t need, or cutting back on other things you enjoy, it’s important so that you can keep your finances in line through inflation.

Diamond’s Personal Savings Accounts can help you manage your money and budget accordingly.

How to Create a Club Account

See for yourself why you should use these free resources that you have access to. It’s as easy as 1-2-3:

- Sign in to NetBranch

- Click on ‘Menu’ then select ‘Open New Account’

3. Select ‘Savings’ then apply for either a Holiday or Vacation Club

After this it will prompt you to make a deposit into your new account. Simply select which account you would like to withdraw from and for how much. It can be as little as a dollar to start. Once you’ve made your deposit, you can accept the terms and conditions and click “submit.” Then your account should be ready to go.

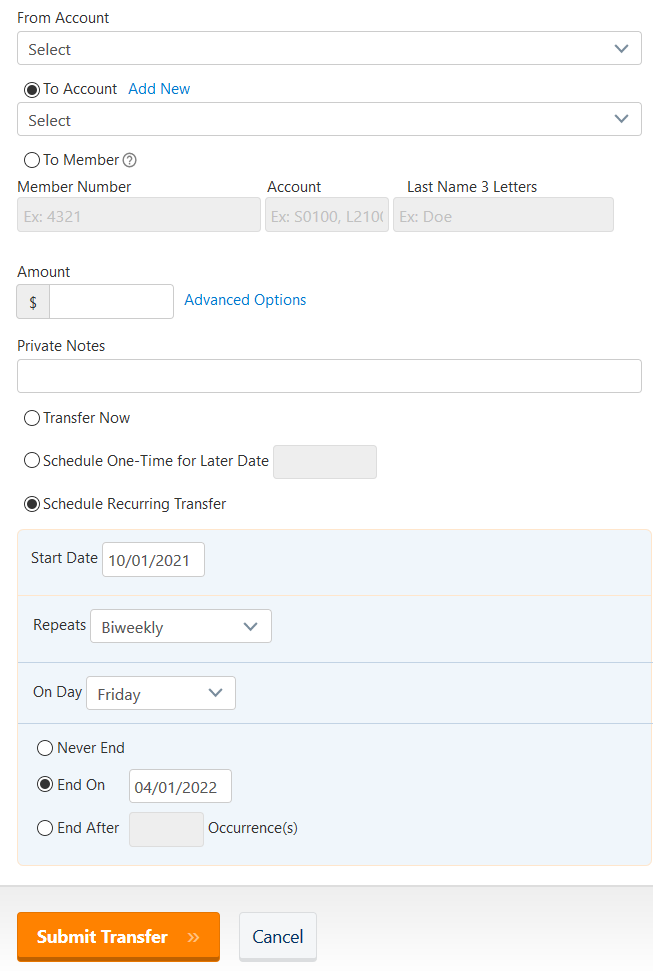

Since you have your new account set up, you can also set up automatic transfers. This way you don’t have to worry about manually entering it every pay day.

4. Sign into NetBranch

5. Click on ‘Transfer”

6. It will then prompt you to select which account you want the money to transfer from, where you want it to transfer to, and for what amount.

7. Select ‘Schedule Recurring Transfer’ and chose the start date, frequency, and when you would like the transfers to stop.

8. Click ‘Submit Transfer’

There you have it. An opportunity accessible through Diamond’s NetBranch that can help set you up for financial success. If you’re interested in opening a club account, follow the above prompts or speak to a Diamond representative.