What You Need to Ask About Commercial Real Estate Buying and Leasing

As a small business owner, whether you build websites, do bookkeeping, or jar your own tomato sauce, you reach a point where you start asking yourself important questions about the future of your business. One of the big questions is, “Should I buy commercial real estate, or should I lease it?”

Leasing or buying retail property is an important step and one that requires plenty of research and preparation. Asking yourself the tough questions about commercial real estate buying and leasing can help you find the right option for your business.

Benefits of Investing in Commercial Real Estate

Deciding to lease or buy commercial real estate is an important step and depends on several factors like your financial situation, business plan, and long-term goals. There are several benefits to both options.

Flexibility and Scalability

Leases, often with shorter terms (3-10 years), provide greater flexibility. Businesses can more easily relocate to a more strategic location or a larger space as they grow, without the complexities of selling property.

Buying a commercial building allows you flexibility for the future. If you find a space that is bigger than you need but for a good price, you have the potential for rental income by leasing out the unused space. Then when the lease expires, and you’re ready to expand, there is a space ready for your business.

Cost Savings

Leasing typically requires significantly less capital upfront compared to purchasing. This frees up valuable funds for other crucial business operations like hiring, marketing, and inventory. Also, lease prices are usually fixed for the duration of your lease, so you can budget ahead.

While the initial investment is higher, owning can be more cost-effective in the long run with fixed mortgage payments compared to potentially rising lease costs.

Tax Benefits

Another deciding factor in the decision to lease or purchase commercial real estate is the tax benefits that each option provides. Property owners can take tax deductions on their mortgage interest payments and property taxes. Additionally, small business owners can claim an annual depreciation of their property on their tax returns.

Leasing commercial property also carries tax advantages. Lease payments can be deducted as a business expense and reduce a business’s tax burden.

What Should I Ask Before I Commit to Buying Retail Property?

Once you’ve learned the benefits of buying a commercial business property, before you sign a contract, there are some questions you need to ask yourself.

1. Why Are You Investing in Commercial Real Estate?

While it might seem straightforward why you want to buy or lease a commercial property, you should have your objectives laid out before you start. A lack of direction and clear answers can derail your plans. Consider the following questions before you make any decisions:

- What are my short- and long-term goals?

- What do I hope to achieve through my investment?

- What does a successful financial return mean to me?

2. Is Leasing or Buying More Financially Responsible?

The geographic region where you set up your office, retail, or manufacturing space can be a big factor in whether it’s more affordable to lease or purchase commercial property. In an area where you can rent commercial space for $2 per square foot, leasing may be the more affordable option. However, a lease rate of $5 per square foot may entice small business owners to pursue the option of buying their own commercial property.

Although small businesses in Berks County and the surrounding regions may not see such big differences, the location where you “set up shop” can affect whether leasing or buying is a better deal.

3. What is the Local Market for Commercial Real Estate?

Having a better understanding of the local PA commercial real estate market can help you answer if buying or leasing a commercial building is the right choice. Start by researching the availability of other commercial properties in the area. A large inventory can help strengthen your negotiating position and let you get the best deal.

However, a large inventory could signify that this might not be the best market to invest in commercial properties. By looking at the local market and past sales/rentals, you can get a sense of whether this is the right time to expand into a commercial space.

4. How Can I Finance Buying a Commercial Building?

The biggest question to ask yourself is how you’re going to finance this purchase. You might have all the capital upfront, but most likely, you’ll need to apply for some commercial real estate loans to help obtain funds. Here are a few you can use if you decide buying a commercial building is the right option.

Traditional Bank Loans: Offered by banks and credit unions, these commercial real estate loans can be customized but often have stricter underwriting requirements.

SBA Loans: Backed by the U.S. Small Business Administration, SBA loans are affordable options with low down payments, longer terms than traditional business loans, and access to funds at competitive rates.

FHA Loans: To promote the development of housing for vulnerable populations—including low-income, elderly, and disabled individuals—the Federal Housing Administration (FHA) insures mortgages for a range of commercial projects.

5. Do I Need a Down Payment for Commercial Real Estate?

Just like buying a new home, purchasing commercial real estate for your business will require a down payment. The required down payment can be 10%–20% of the purchase price, depending on the type of commercial real estate loan you apply for. In contrast, leasing space requires an initial deposit and monthly rent payments.

6. How Much Flexibility Do I Need?

When you’re leasing a space for your small business operations, you have the ability to move out when your lease comes to an end. So if your business continues to grow, you can relocate to a bigger space or different location without the added step of having to sell your current business space.

7. Does the Property Need Repairs?

Commercial real estate follows a strict set of rules and regulations. To meet these requirements, you need to make sure your property is up to these standards. Knowing what repairs the building could need, either now or in the near future, can factor into your investment.

Maintaining a commercial property can get expensive, especially if you own the building. If you’re leasing, you could still be responsible for repairs depending on the terms of your lease. If you have an idea of the expenses, you can decide if these costs are too much for your business.

8. What Does the Pro Forma Say?

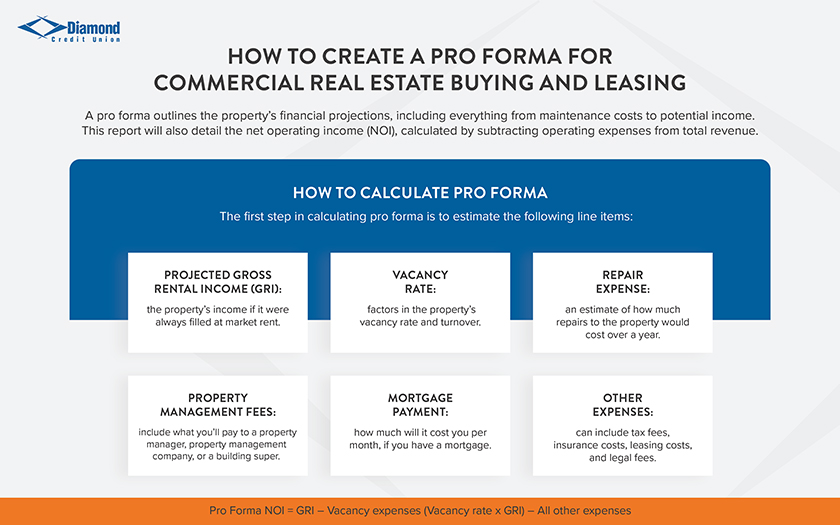

Getting a pro forma can provide you with crucial information to help in the decision-making process. A pro forma is a document that outlines everything from maintenance costs to potential income.

This report will also detail the property’s net operating income, or NOI. You calculate NOI by subtracting the property’s operating expenses from its total revenue. As an investor, understanding the NOI is vital, as it provides a clearer and more direct assessment of the property’s underlying financial potential and profitability.

Become a Partner with Diamond

Making the decision about commercial real estate buying and leasing is a big deal, and one you shouldn’t do alone. Reach out to Diamond’s Business Lending Team, who can walk you through your options and help you pick the best one.