How Can You Improve Your Credit Score to Buy a House?

As a first-time homebuyer, do you know the most important piece of information you should have at your fingertips? It’s not the square footage of your dream home or even the current mortgage rates. Nope, it’s your credit score. When you’re buying a home, or making any large purchase, your credit score is going to be the basis for much of the decision-making that happens during the homebuying process. Homeownership with a lower credit score is possible, but you’ll find the journey to be much easier if you take steps to improve your credit score to buy a house.

Your Credit Score Basics

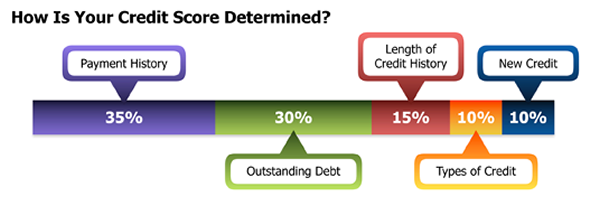

Your credit score is a representation of how creditworthy you are and how confident lenders can feel that you’ll repay your debts. Your credit score is determined by looking into your financial background and assessing the following factors:

- Payment History: This is determined by whether you make your loan and credit payments on time and in full or not.

- Credit Capacity: This is represented by the amount of money you owe and the percentage of the available credit you have used.

- Length of Credit History: This shows how long you’ve been managing credit and responsibly making payments, either on loans or credit cards.

- Accumulation of New Debt: This factor looks at the new debt you’ve acquired in the last 12-18 months or inquiries into your credit score by potential lenders. A lot of new debt, all at once, can hinder your score.

- Credit Mix: Certain kinds of debt, such as installments debt (auto loans, student loans) can raise a score, while revolving debt (credit cards) can lower a score. Lenders look for a smart balance.

Credit scores range from 300-850. A score below 600 is typically considered bad credit, while a score above 700 is typically considered very good credit.

Do you know your credit score? Certain websites provide the ability for you to check your credit score once a year, at no cost to you. Members of Diamond Credit Union can also meet with a professional to review their credit score and get a full financial health check-up.

Poor Credit Affects Your Mortgage Options

In many cases, lenders will tier their interest rates based on credit score. So, for example, an applicant with a credit score of 700+ might be charged 1.99% interest on a loan, while an applicant with a credit score of 600-649 might be charged 6.99%. A higher interest rate can result in you paying thousands of dollars more over the life of the loan.

Get Your Credit into Shape

Just because you can buy a home with a lower credit score, doesn’t mean you have to. Slow down and take some time to tackle these steps to improve your credit score to buy a house.

- Pay down your debt. Starting with high-interest debt is a smart strategy. Put as much extra money as you can each month towards paying off the loan or credit card that carries the highest interest rate. But keep making the minimum payments on everything else!

- Make your payments on time. The biggest factor that goes into calculating your credit score is your payment history, so making payments on time can have the biggest impact. And good news, a current payment history of on-time payments carries more weight than a past history of missed payments.

- Don’t take on any new debt. If homebuying is a priority, then put any plans of buying a new car or applying for a new credit card on hold.