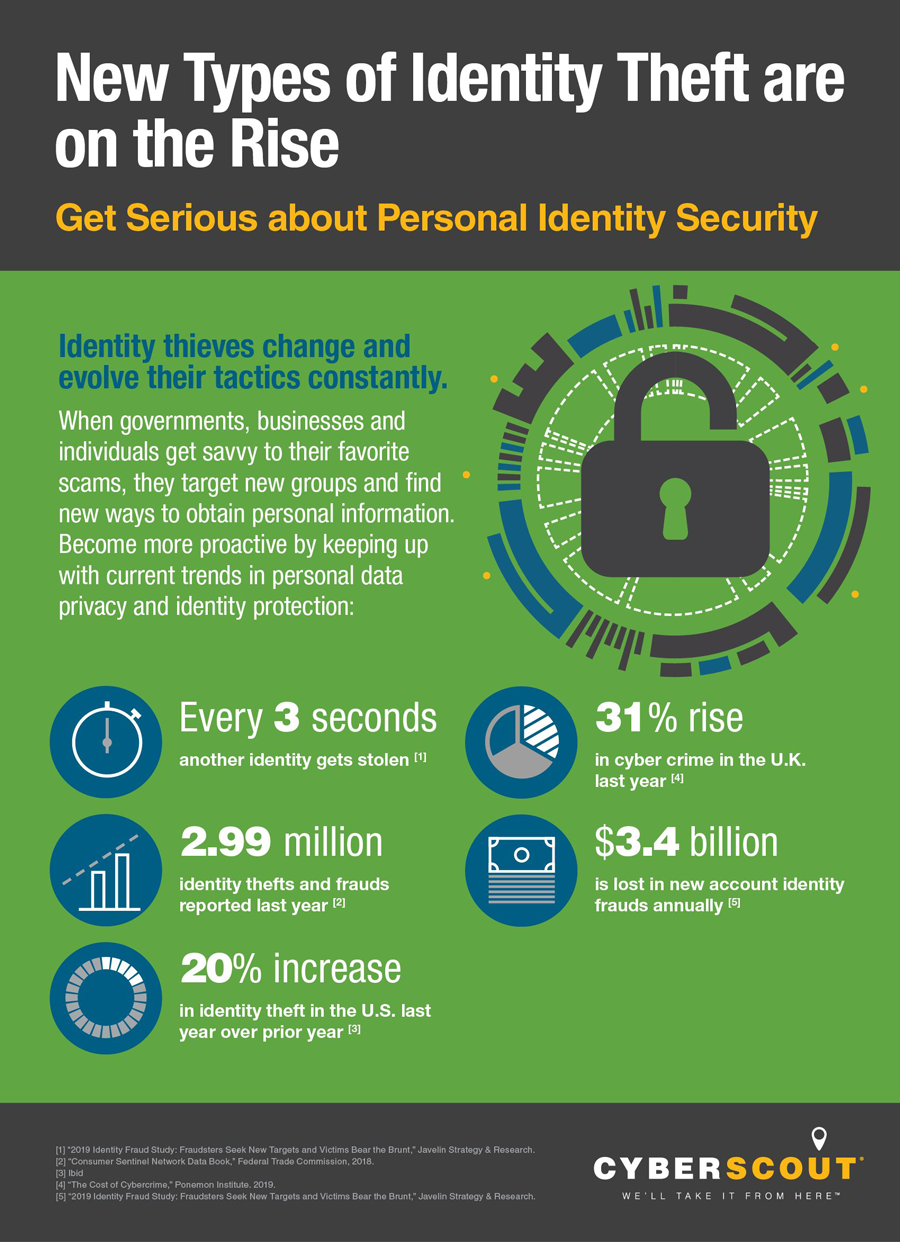

As identity theft exploded, consumers adopted strategies and tools to protect their personal information.

As identity theft exploded, consumers adopted strategies and tools to protect their personal information.

But the harder you work to stay safe, the more creative thieves become with new targets and methods. Take time now to review your cyber and offline personal data privacy protection habits. Tighten up your privacy with these five tips:

1. Be careful on social media.

If your privacy settings are not strict enough or you share too much personal information, you could be increasing your risk. If identity thieves monitored your posts and profiles, could they find your birthday? Complete name? Spouse or child’s name? Address or phone number? Pet’s name (a commonly used password)? Ratchet up security settings, limit your community to close family and friends, and don’t overshare.

2. Guard against offline privacy risks.

Identity thieves love to work online, but they aren’t above stealing your personal information from trash bins, mailboxes, or from credit cards, wallets, or personal devices. Stop your mail when you travel. Scan bills, statements, and credit card offers for personal information – and shred them if you are throwing them away. Don’t give personal information in unsolicited phone calls or emails.

3. Push back when asked for your personal identification number.

Far too many businesses want to have their customers’ social security or personal identification numbers. Every person with access to it is one more person who could mishandle it. Limit whom you provide it to and speak quietly if asked for it in crowded rooms.

4. Use excellent password hygiene.

You’ve probably heard that you should change passwords regularly and avoid using easy-to-remember passwords. It’s critically important that every financial account (banks, credit unions, and credit issuers) is protected by a strong password containing a random collection of uppercase and lowercase letters, numbers, and symbols. Never use the same password for multiple financial accounts.

5. Monitor your family’s personal and financial information closely – including the kids.

The most common identity frauds involve opening new credit cards or taking out loans with stolen identity information. Protect your family by carefully checking each person’s credit reports, or rest easier using a 24/7 credit and identity monitoring service to alert you to any new account activity.