4 Successful 401(k) Alternatives

Since retirement can last 30 years or more, it’s important to get a retirement plan in place as soon as possible. An employer-sponsored 401(k) is one of the most popular retirement planning options for American workers. In 2023, 70% of workers in private companies had access to a retirement plan, with 53% of those workers participating. We’ve put together a list of 401(k) alternatives you might consider to round out your retirement plan. Some you may already be familiar with, and some may be a little more surprising.

Individual Retirement Account (IRA)

Beyond a 401(k), an IRA is probably the next most popular option for retirement savings. The maximum annual contribution limit for a 401(k) is $23,500, and when workers max out that contribution limit, they turn to Individual Retirement Accounts.

Favored because of their tax benefits, an IRA is a personal account that you can open through your credit union or bank. Whether you open a Traditional IRA or Roth IRA, you can contribute up to $6,500 to an IRA account annually ($7,500 if you’re 50 years or older)

Roth IRA

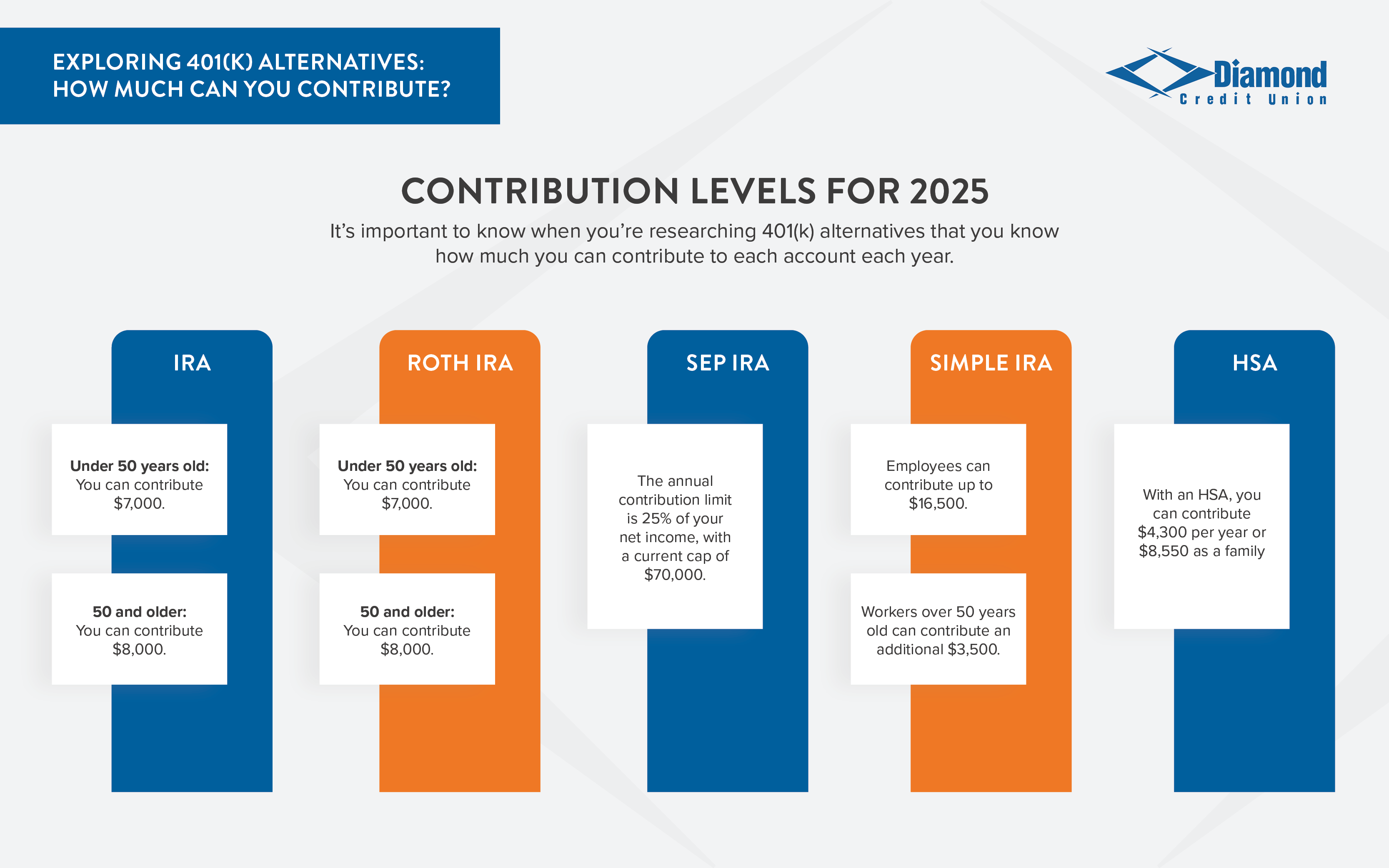

A Roth IRA differs from a traditional IRA by its tax treatment. Contributions to a Roth IRA are made with after-tax dollars, meaning you pay taxes on the money now. The maximum contribution is $7,000 if you’re under 50 years old and $8,000 if you’re older than 50. This provides a significant advantage in retirement, as all withdrawals, including both your contributions and investment earnings, are tax-free.

This IRA tax benefit, coupled with the absence of required minimum distributions (RMDs), allows your retirement savings to grow tax-free indefinitely, and you can even continue contributing after age 70 ½. Furthermore, the ability to leave funds in the account throughout your lifetime makes it a valuable tool for long-term financial planning.

But which IRA to choose? Both have tax benefits, so it depends on how you’d like your income to be taxed. Traditional IRA contributions are tax-deductible, and your earnings grow tax-free, but you will be taxed when you withdraw your savings from the account. With a Roth IRA, you are taxed on the funds you contribute, but withdrawals and earnings are tax-free if you meet all withdrawal criteria.

Self-Employed Retirement Options

If you’re one of the 44 million Americans who are self-employed or have been hired by a self-employed boss, then a 401(k) may not be a type of retirement option that’s available to you. There are other 401(k) alternatives that you can take advantage of to grow your retirement savings in the absence of an employer-sponsored program.

SEP IRAs

If you are a business owner with one or more employees or if you earn freelance income, then you can open a SEP IRA, which is a type of Traditional IRA. The annual contribution limit is 25% of your net income, with a current cap of $70,000.

Simple IRAs

If you are a small business owner with 100 or fewer employees, each making more than $5,000 each, you can participate in a Simple IRA plan. Employees can contribute up to $16,500, with workers over 50 years old being able to contribute an additional $3,500. A Simple IRA requires the business owner to make contributions on the employees’ behalf, either dollar-for-dollar up to 3% of their salary or a flat contribution of 2% of their salary.

Living Mortgage-Free

You may not necessarily consider your mortgage as a 401(k) alternative, but it can be. When you enter your retirement years mortgage-free, you are eliminating one of your biggest expenses each month and freeing up money that you can put towards your living expenses or add to your savings or investment accounts.

Home-related expenses are a larger spending category for older Americans than even health expenses. But when retirees carry no mortgage, their monthly housing expenses are less than a third of those who are still paying mortgage bills.

There is some debate about “Should I pay off my mortgage before I retire?” or “Should I keep my mortgage in retirement?” Even though interest rates have remained low over recent years, there are still many benefits to not carrying mortgage debt into your older years.

- You can easily control your cash flow and adjust what you spend each month

- When the market fluctuates, you won’t necessarily need to withdraw from your retirement accounts

It’s important to note, however, that paying off your mortgage before retirement should not be done if it pulls money out of your retirement savings plans, like your 401(k) or IRA.

Health Savings Account

Here’s another retirement option other than a 401(k) that you might not have considered. Once you’ve maxed out your contributions to your 401(k) and IRA, consider using a Health Savings Account to grow your retirement savings tax-deferred. Here’s how it works.

Health Savings Accounts are available to anyone whose health insurance plan has a high deductible, and the money in your HSA is typically used to help offset the cost of medical expenses. You can withdraw funds, tax-free, at any time, to pay for qualified medical expenses.

With an HSA, you can contribute $4,300 per year or $8,550 as a family. These contributions roll over year after year, so your money is not lost if it’s not used. Where HSA’s come into play as a retirement option is after age 65, you can withdraw money from your account for any use, medical expenses or otherwise. The money you withdraw, however, will be taxed similarly to your Traditional IRA.

Investment Accounts

Opening a taxable brokerage account, either individual or joint, allows you to contribute unlimited funds towards your retirement savings. This supplements traditional retirement accounts and offers a wide array of retirement investment options, including stocks, mutual funds, bonds, and exchange-traded funds.

When investing in securities or bonds, any profits from appreciation or dividends are taxed as long-term capital gains, provided the investments are held for over a year. However, it’s important to remember that you will likely owe taxes on any interest, dividends, or gains realized from sold investments within the tax year.

While a taxable account can significantly enhance your financial plan, it demands careful planning and self-management. Using a taxable account alongside your retirement account means you need to actively manage your investments and understand the tax rules.

Understanding the tax consequences of different investment choices is important to maximizing your gains and understanding how a taxable brokerage account can work as an alternative retirement plan.

Real Estate Holdings

Real estate can be a solid way to grow your retirement savings, but it’s a long-term strategy. Whether you’re thinking about rental properties or flipping houses, you’ll need some cash to get started. It can cost more upfront, but the regular income potential can increase your savings.

If you don’t want to directly manage the property as a landlord, there are other ways to get into real estate, such as investing in Real Estate Investment Trusts (REITs), Real Estate Investment Groups (REIGs), or participating in online real estate crowdfunding platforms. These options let you invest in property without all the day-to-day management.

Plus, real estate tends to gain value over time. So, if you buy a home or building now and hold onto it, you could end up with a nice profit when you’re ready to retire.

Protect Your Retirement Options

Planning for retirement can be overwhelming. With all the retirement investment options out there, it’s hard to know what the first steps of retirement planning are.

But remember, no matter which of the 401(k) alternatives you pick, it’s recommended that you consult your financial planner for the strategy that benefits your retirement option. Diamond’s Financial Planning team has the resources to help you find the right alternative retirement plan for you.