Business Loans And Lines Of Credit

Loan And Credit Options For Small Businesses

Visa® Business Rewards Credit Card

A business credit card could help you run your business more efficiently. Use it to easily make purchases with vendors and suppliers or for quick access to cash. If you have multiple employees, it serves as a great option to keep their expenses in check.

0% APR* Intro Rate for the First 6 Months on Purchases & Balance Transfers. After the introductory period, the variable rate starts as low as 11.99% APR*

Visa Business Rewards Credit Card Benefits:

- No annual fees and low monthly payment

- Access cash at 55,000+ No-Fee ATMs

- Consolidated billing

- Zero liability for unauthorized transactions

- 10,000 reward points after your first purchase or balance transfer

- Diamond Visa Credit Card App helps you manage your account

- Quick and safe purchases with digital wallet and contactless payment technology

Commercial Loans

Commercial Lending with flexible terms and competitive rates, including small business loans, commercial real estate financing, business lines of credit and business credit cards. We are dedicated to serving the small businesses in our local community.

- Decisions made locally

- Flexible loan terms

- Competitive interest rates

- Prompt and efficient customer service

- Commercial Real Estate Loans

Non-Real Estate Loan/Line of Credit

Apply for a variety of small business loans and lines of credit.

Commercial Real Estate Loans

Lending decisions on commercial real estate financing and business loans are also made locally. We want to hear from you about your bigger dreams and projects and how Diamond can help.

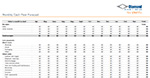

Monthly Cash Flow Forecast

Download Diamond’s Cash Flow Forecasting Excel sheet to predict when cash will come in and when it needs to be paid out. This handy tool will help you see when you may have cash deficits or surpluses so you can make informed loan decisions.

Download Helpful Cash Flow PlannerBusiness Auto Lending

If you’re in need of a vehicle or fleet of vehicles for the successful operation of your business, you’ve come to the right place.

Business Auto Loan Financing & Refinancing

Diamond offers new and used business auto loan financing up to $200,000 with competitive rates, and terms ranging from 48 to over 73 months.

We may be able to save you money by refinancing your current Business Auto Loan(s). Get started now by providing us with some information.

Specialized Business Auto Loans

If your business requires the use of specialized vehicles we’ve got you covered with affordable rates and terms that vary from the traditional business auto loan. Schedule time to talk with our Business Services Team about a specialized business auto loan solution, so you are able to run your business the way you need to.

*Annual Percentage Rate (APR) may vary according to overall credit history, payment method, and payment of processing fees. Certain conditions and restrictions may apply. Offer valid for new business Visa applications. The promotional rate is valid for 6 months from the time the card is opened. After 6 months, the APR will be applied to the full remaining balance at the regular qualifying rate and monthly periodic rate as specified in the cardholder agreement. The regular rate is variable based on the value of an index and may be changed monthly. The maximum rate that can be charged is 18.00%APR. Promotional offer may end at any time.