The thought of improving your credit health can weigh heavily on the mind, especially when you are already under financial stress or when you are in a situation where your credit is about to be under scrutiny. Take control of your credit health by understanding the ins and outs of your credit history and what goes into improving your score.

For this article, we turned to some valuable resources at Diamond Credit Union. Tracie Tolland, Director of Lending, and Paul Yacobowsky, Director of Sales, weighed in on ways to improve credit health.

Who Checks Your Credit and Why

When it comes to your credit report, it’s important to understand who views it and their reasons for looking at it. Tracie helps to set the record straight. Here’s what she had to say:

“Credit reports are reviewed by many different types of businesses for various reasons. This is why it so incredibly important to maintain good credit. Your credit report will be viewed any time you borrow money and many times when you sign up for a service, such as electric or telephone service.

Your credit report also reflects how much debt you currently have. Can you afford everything that you have or have you over extended yourself? A credit report is a quick snap shot of one piece (but an important one) of your financial profile.”

Do you need a car loan, a mortgage, credit card, apartment or insurance? A financial institution, landlord, or even an insurance company may be viewing your credit as one of the tools to evaluate whether or not you are a low or high credit risk. The ultimate concern from them is, ‘will this person repay us?’ Your credit report is a reflection of how you have paid your bills in the past and how they think you will repay them in the future.

What Constitutes Bad Credit

In order to understand good credit vs. bad credit, it’s helpful to see the tiered credit score range used to determine lender risk. Paul provided a breakdown of credit score ratings that Diamond CU follows, but this score model may vary by financial institution:

740+ = Minimal Risk (P)

690-739 = Low Risk (A)

650-689 = Moderate Risk (B)

610-649 = Moderate to High Risk (C)

609 and below = High Risk (D & E)

How Will You Be Directly Affected by Bad Credit?

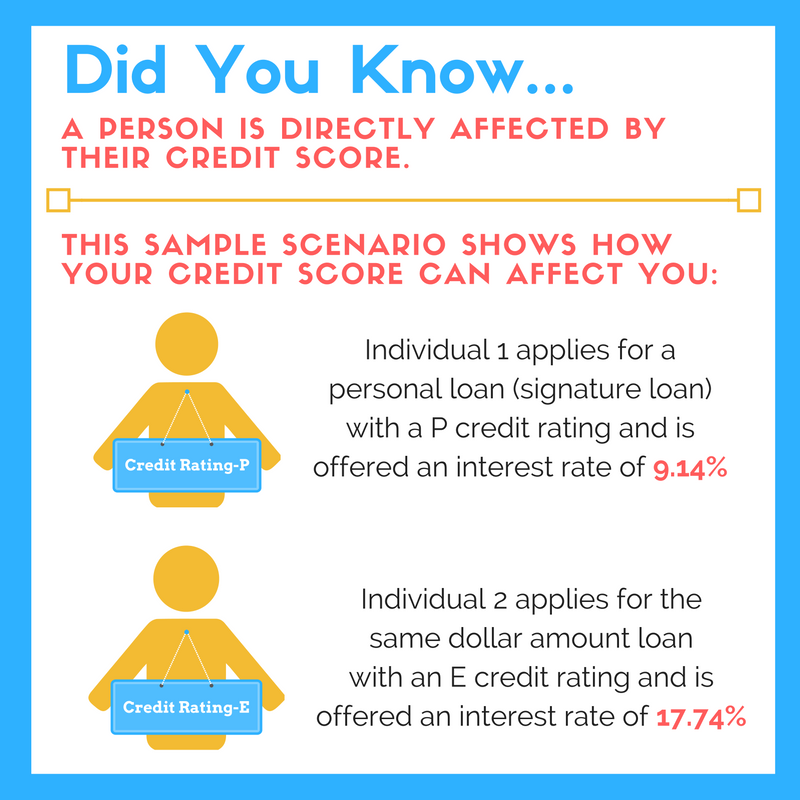

Bad credit directly affects your financial profile in several ways. Take a look at this sample scenario that Paul provided to better understand the effects of a poor credit score:

Approval for a loan can be difficult

The lower your credit score, the less likely you are to find a lender to approve you. If you do get approved, you will be subject to higher interest rates and more restrictive terms.

Difficulty Renting

Landlords are hesitant to rent to those who have a record of being faulty on payments. This could also have a major impact on finding housing.

Higher Insurance Premiums

With bad credit, you are likely to pay higher insurance premiums. In fact, 95 percent of auto insurers and 85 percent of homeowner insurers factor credit into their decisions.

How Long It Will Take Your Credit Report to Get Better

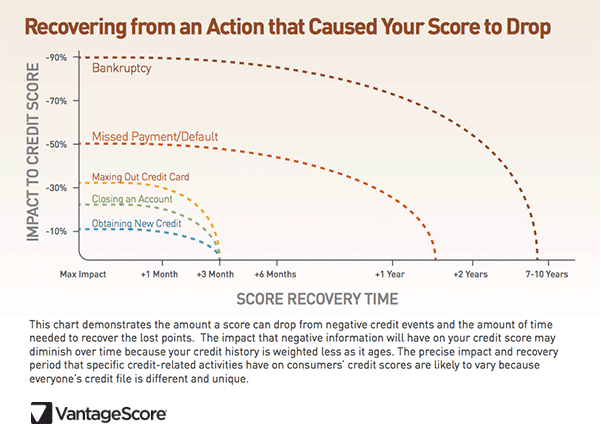

It might seem impossible for your credit to improve. However, time can heal credit. After about seven years, negative information can be removed from your report. Keep in mind that collection accounts can take seven years, plus an additional 180 days, from the original date of delinquency. Additionally, bankruptcies could be reported for as long as 10 years.

The various actions that affect credit negatively include:

• Bankruptcy

• Missed Payment/Default

• Maxing Out Credit Card

• Closing an Account

• Obtaining New Credit

Take a look at this chart from Vantage Score for a detailed look at score recovery time depending on various actions on your credit report:

When your credit takes a turn for the worse, Tracie recommends taking these steps:

- Notify your creditors.

- If you have missed payments, get current and stay current.

- Pay down high revolving debt. Keep credit card balances low but don’t close the cards.

- Don’t open new credit cards. This could actually lower your score.

- Slowly apply for new credit after you have cleaned up what you already have. Secured loans are a good way to start.

Steps You Can Take To Improve Your Credit

According to the Fair Credit Reporting Act, you are entitled to one free credit check per year. Take advantage of this, even if you aren’t applying for anything, to check for errors or fraud that could potentially harm your credit.

Additionally, Tracie suggests the following:

- Always pay your bills on time.

- Start establishing slowly. Don’t apply for a lot of credit in a short amount of time.

- Keep credit card debt to a reasonable amount. Make sure there is always an available limit on your credit cards.

- Don’t borrow more than you can reasonably handle. Remember the daily living expenses that you also have such as food, gas, etc.

Number 4 is something that many people don’t think about when borrowing and find themselves in trouble later. We all have daily expenses. These daily expenses add up and must be factored into your budget.

Paul suggests to increase your credit capacity. He explains that if you have a $1,000 credit limit with a $1,000 balance, you are at 100% capacity. If you pay down to $500, you are now at 50% of your credit capacity. Creating capacity is the fastest way to improve your overall credit score, he says.