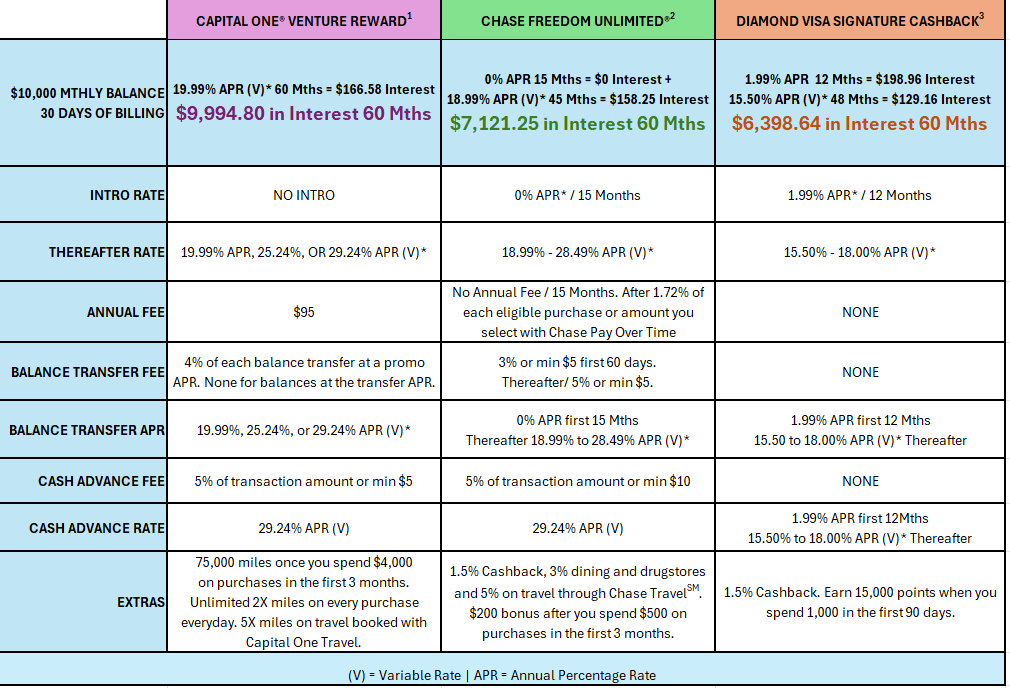

We compared some of the most popular credit cards on the market with Diamond’s Visa Signature Cashback card to show you how much you could be saving by transferring your balances to Diamond.*

* This is an example only and based on simple interest. Minimum payments are not figured into the calculations, and rates may vary based on credit score, credit history, and other factors. Information for this comparison was taken from Chase Freedom Unlimited / JP Morgan Chase Co. https://creditcards.chase.com/cash-back-credit-cards/freedom/unlimited and Capital One Venture Rewards / Capital One https://www.capitalone.com/credit-cards/venture/ as well as WalletHub. WalletHub, wallethub.com an article by John S. Kiernan, Credit Card Editor – The underlying data is compiled from credit card company websites or provided to WalletHub directly by the credit card issuers. They also leverage data from the Bureau of Labor Statistics to develop cardholder profiles, used to estimate cards’ potential savings. Accurate as of July 14, 2025. 1. Capital One Venture Reward: $10,000 x 19.99% = $1999/12 = $166.58 x 60 = $9,994.80 2. Chase Freedom Unlimited: $10,000 x 18.99% = $1899/12 = $158.25 x 45 = $7121.25 3. Diamond Visa Signature Cashback $10,000 x 1.99 = $199/12 = $16.58 x 12 = $198.96 and $10,000 x 15.50 = $1550/12 = $129.16×48 = $6199.68 + $198.96 = $6398.64. Please see disclosures for each credit card for details and other factors that may apply to rates and fees that may be charged.