What is Escrow on a Mortgage?

If you’re new to homeownership or just trying to better understand your monthly mortgage bill, you may be wondering: What is escrow on a mortgage? Mortgage escrow plays an important role in managing your property taxes and homeowners insurance.

This blog breaks down what escrow on a mortgage means, how it works, and what you need to know about mortgage escrow rules, payments, and potential changes over time.

Understanding Escrow

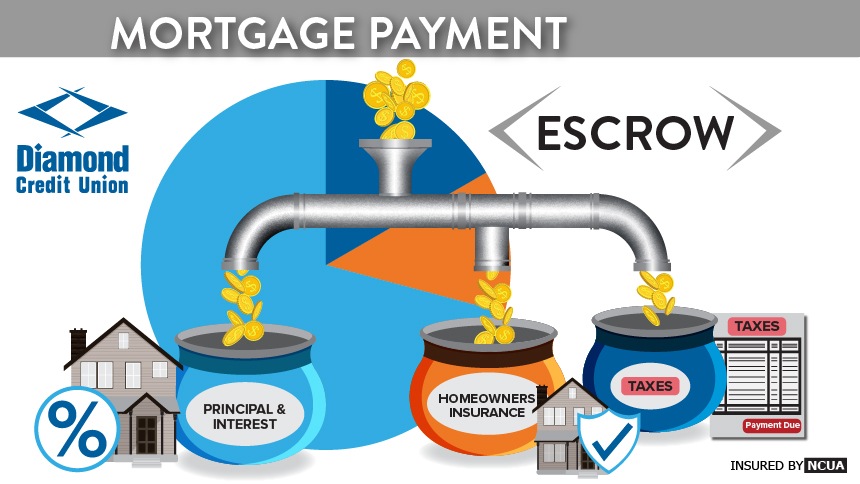

Escrow on a mortgage is a separate account your mortgage lender uses to collect and pay your property taxes, school taxes, and homeowners insurance. Each month, you pay a portion of these costs as part of your mortgage payment, and the lender sets that money aside in your escrow account.

When those bills are due, the lender pays them on your behalf, helping to ensure that you don’t miss a payment. Instead of paying property taxes or insurance premiums on your own, escrow helps you budget for them more easily and ensures timely payments.

What is an Escrow Account?

A mortgage escrow account is essentially a savings account managed by your lender. It’s not used to pay down your loan principal or interest. It’s strictly for holding the funds needed for taxes and insurance.

The amount collected for escrow can vary based on your insurance premiums and local property tax rates. If these costs go up, you might see a mortgage escrow increase in your monthly bill. If there’s not enough in your escrow account to cover your bills, you may also experience a mortgage escrow shortage.

On the other side, you might have excess in your mortgage escrow account. When this happens, your lender will send you a check in the amount of the excess funds.

Why Did My Mortgage Payment Go Up?

If you’ve noticed an unexpected change in your monthly mortgage bill, you’re not alone. One of the most common reasons for this is a change in your mortgage escrow balance. Here are a few possibilities:

- Escrow shortage: If your escrow account didn’t have enough to cover taxes or insurance, your lender may raise your payment to make up the difference. An escrow shortage can occur when your property value is reassessed for a higher amount.

- Escrow increase: Rising property taxes or insurance premiums can lead to a larger monthly escrow requirement.

- Annual analysis: Lenders review escrow accounts yearly. If costs have changed, they’ll adjust accordingly based on mortgage escrow rules.

Can Paying Extra on a Mortgage Help?

Yes, and it can make a big difference. While escrow helps manage taxes and insurance, paying extra on the principal of your mortgage loan can reduce interest over time. Making an additional principal payment each month, separate from your escrow contribution, helps you pay off your mortgage faster and save money in the long run.

However, it’s important to remember that any extra payments go toward your loan, not your escrow. You’ll still need to cover your full escrow requirement every month.

Tips for Managing Your Mortgage and Escrow

Now that you understand what escrow on a mortgage means, here are a few tips to keep things running smoothly:

- Review your annual escrow analysis: This shows how your lender calculated your new escrow payment and whether there’s a shortage or overage.

- Plan for increases: Property taxes and insurance can go up over time, so keep that in mind when budgeting.

- Consider paying extra on your mortgage: Even a small additional principal payment can help reduce your loan balance faster.

- Stay informed about mortgage escrow rules: Lenders must follow guidelines about how much they can collect and how often they analyze your account.

So, what is escrow on a mortgage? It’s a helpful system designed to make homeownership easier by managing your taxes and insurance payments. While it can sometimes lead to changes in your monthly payment, like a mortgage escrow increase or escrow shortage, understanding how it works puts you in control.

By keeping an eye on your escrow account, reviewing statements regularly, and making smart decisions like paying extra on a mortgage, you can stay ahead of the curve and manage your mortgage with confidence.

If you have budgeting questions or are looking for guidance to budget for your mortgage, Diamond has HERO Financial Counselors available to help you succeed. Diamond’s team of mortgage experts are also here to answer your mortgage questions.