Get to Know Your Credit Score

Get to know your credit score so you can better understand your financial health, as it influences your ability to secure loans, obtain favorable interest rates, and even impacts opportunities like renting an apartment or getting a job. Here’s an updated guide to help you navigate the current credit landscape as of January 2025 so you can get to know your credit score.

What Is a Credit Score?

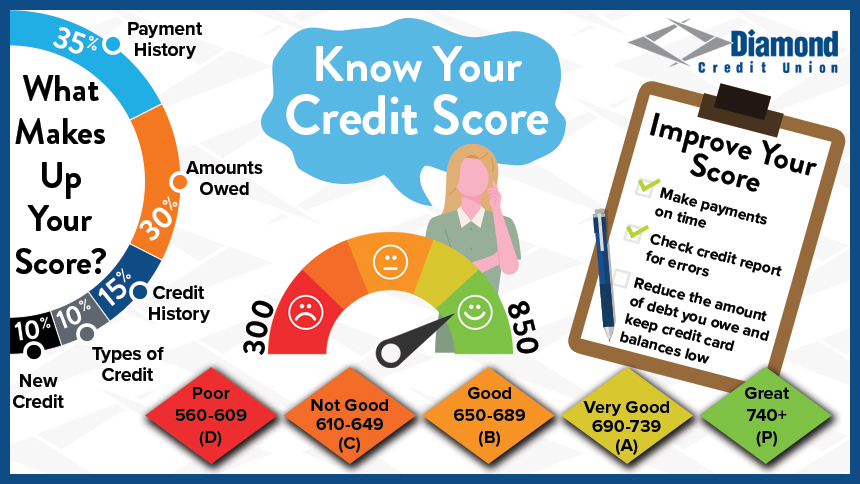

A credit score is a numerical representation of your creditworthiness, typically ranging from 300 to 850. Lenders use this score to assess the risk of lending to you. The higher your score, the more favorable terms you can expect.

Key Factors Influencing Your Credit Score

1. Payment History (35%): Consistently making on-time payments on your credit obligations is crucial. Late or missed payments can significantly lower your score.

2. Credit Utilization Ratio (30%): This is the ratio of your current debt to your available credit limits. It’s advisable to keep your credit utilization below 30%, but aiming for under 10% can give you an extra boost.

3. Length of Credit History (15%): A longer credit history provides more data on your financial behavior, which can positively impact your score.

4. Credit Mix (10%): Having a diverse mix of credit accounts, such as credit cards, a mortgage and auto loans, can favorably influence your score.

5. New Credit Inquiries (10%): Opening multiple new credit accounts in a short period can lower your score due to hard inquiries.

Recent Changes in Credit Reporting

Medical Debt Removal

As of January 2025, the Consumer Financial Protection Bureau (CFPB) has finalized a rule that bans unpaid medical bills from appearing on credit reports. This change is expected to improve the credit scores of approximately 15 million people, with an average increase of 20 points.

Credit Score Model Updates

The Federal Housing Finance Agency (FHFA) and Government-Sponsored Enterprises (GSEs) have updated the Enterprise Credit Score Models and Reports Initiative. The implementation date has been revised from the fourth quarter of 2025 to a to-be-determined date, allowing more time for the industry to adapt to new credit score model requirements.

Tips to Improve Your Credit Score in 2025

1. Timely Payments: Ensure all your bills, including loans and credit cards, are paid on time. Setting up automatic payments or reminders can help maintain consistency.

2. Manage Credit Utilization: Keep your credit card balances low relative to your credit limits. If possible, pay off balances in full each month.

3. Regularly Review Credit Reports: Obtain your free annual credit report from each of the three major bureaus—Equifax, Experian, and TransUnion—to check for inaccuracies or fraudulent activities.

4. Limit New Credit Applications: Be strategic about applying for new credit. Multiple hard inquiries in a short time can negatively affect your score.

5. Diversify Credit Types: If appropriate, consider having a mix of credit accounts, such as a credit card and an installment loan, to demonstrate responsible credit management.

Monitoring Your Credit

Staying informed about your credit status is more accessible than ever. Utilize free services to monitor your credit score and receive alerts about significant changes. Regular monitoring can help you make informed financial decisions and quickly address any issues that arise.

By understanding and actively managing the factors that influence your credit score, you can enhance your financial standing and access better opportunities in the future. Diamond Credit Union offers free credit reviews for members to help them monitor and improve their credit. Schedule an appointment to get to know your score better.