How an Express Cash Line of Credit Works

When life throws unexpected expenses your way, from emergency car repairs to surprise medical bills, or even a spontaneous home improvement project, having quick, flexible access to funds can make a huge difference. That’s exactly where an express cash line of credit can be utilized as a financial tool for members.

An express cash line of credit is a revolving line of credit that you can draw from whenever you need money, without having to reapply each time. Unlike a traditional loan that gives you one lump sum, a line of credit gives you ongoing access to cash up to your approved limit over a 7-year draw period. As you make payments, your available credit replenishes, allowing you to borrow again if necessary.

How It Works

Think of the express cash line of credit like writing yourself a personal loan on demand. Once approved, you don’t have to repeat the application process every time life demands extra cash. Simply transfer the funds you need through Diamond’s digital banking system and make monthly payments on the portion of the line of credit you’re using, all while having access to the remaining available credit.

This structure offers flexibility similar to a credit card, but with some key advantages. First, because it’s a line of credit rather than a standard credit card, you often benefit from lower interest rates and the ability to control how much you borrow and when you borrow it. Plus, you only pay interest on the funds you actually use.

What You Can Use it For

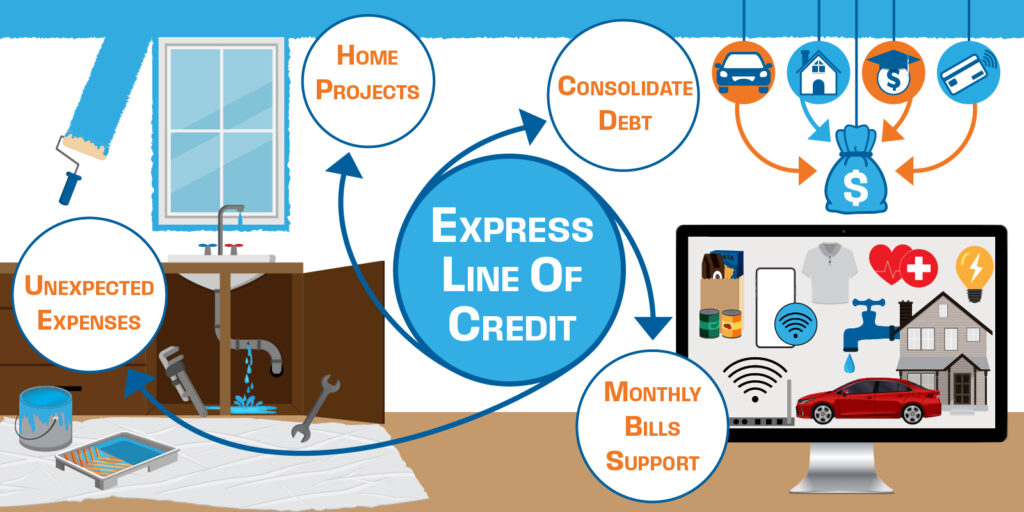

With a line of credit, there’s no strict rule on how the funds must be used, which makes it ideal for both planned and unplanned expenses. A few common scenarios include:

- Emergency expenses – Unexpected bills or urgent repairs can pop up at any time. This line of credit lets you cover those costs without tapping into your savings.

- Home projects – Whether you’re updating a room or taking care of a repair, borrowing only what you need gives you both control and convenience.

- Debt consolidation – In some cases, it may make sense to use part of your line of credit to consolidate high-interest debt or credit card balances, potentially saving money on interest.

- Everyday support – If monthly expenses run higher than anticipated, this line of credit provides a reliable backup source of cash.

Since you don’t need to reapply for credit every time you draw an advance, this can be useful as a safety net, like having an emergency fund ready when you need it most.

A Flexible Financial Tool

In today’s world, financial needs don’t always fit into predictable budgets. That’s why our Express Cash Line of Credit can be a valuable part of your overall financial strategy. Whether you’re facing occasional surprises or planning ahead for larger expenses, this flexible line of credit gives you access to cash and the freedom to borrow responsibly.

To explore if this option is right for you, you can have a Diamond representative contact you. If you’re ready to apply, you can also apply online.