Credit Card vs Debit Card: Choosing the Right Option for Your Finances

In today’s world, swiping or tapping a card is second nature, yet many people don’t fully consider the financial implications of using your credit card vs debit card. The differences between them can have consequences for everything from your financial security to your long-term credit health.

This guide will examine the strategic advantages and hidden risks of each option, enabling you to select the most suitable card for every purchase.

How Does a Debit Card Work?

Debit cards work much like cash. Your debit cardis tied to your checking account, and when you make a purchase, the amount is deducted from your checking account. Debit cards also allow you to access cash at ATMs or at store checkouts that offer a “cash back” option.

If you use online banking, you can immediately see your transactions and your true account balance at any time. This is beneficial when you’re sticking to a budget.

What are the Limitations of Using Your Debit Card?

While debit cards can help you avoid debt, there are some limitations. One is that they don’t help you build your credit score. Unlike your credit card payments, which are reported to the credit bureaus, debit card transactions are not reported.

Since debit cards are also linked to your checking account, if you spend more than what’s in your account, you may be charged an overdraft fee or the transaction may be declined. You may also be charged a fee if you withdraw cash from an out-of-network ATM.

How Does a Credit Card Work?

Using a credit card is like a short-term loan. You’re “borrowing” money from your credit union, bank, or credit card company to pay for your purchase. At the end of the billing cycle, you’re required to pay back the amount that you borrowed. If you cannot pay the amount in full, you’re charged interest, just like with any other loan.

What are the Limitations of Using Your Credit Card?

Shopping with credit cards can be a bit of a double-edged sword. If you use credit cards responsibly, such as by not exceeding your credit limit and by paying your balance off each month, then credit cards can be a great tool in building your credit history and raising your credit score.

However, with the high spending limits provided by many credit cards, you can quickly find yourself spending more than you can afford to pay off each month.

Deciding Which Card to Use

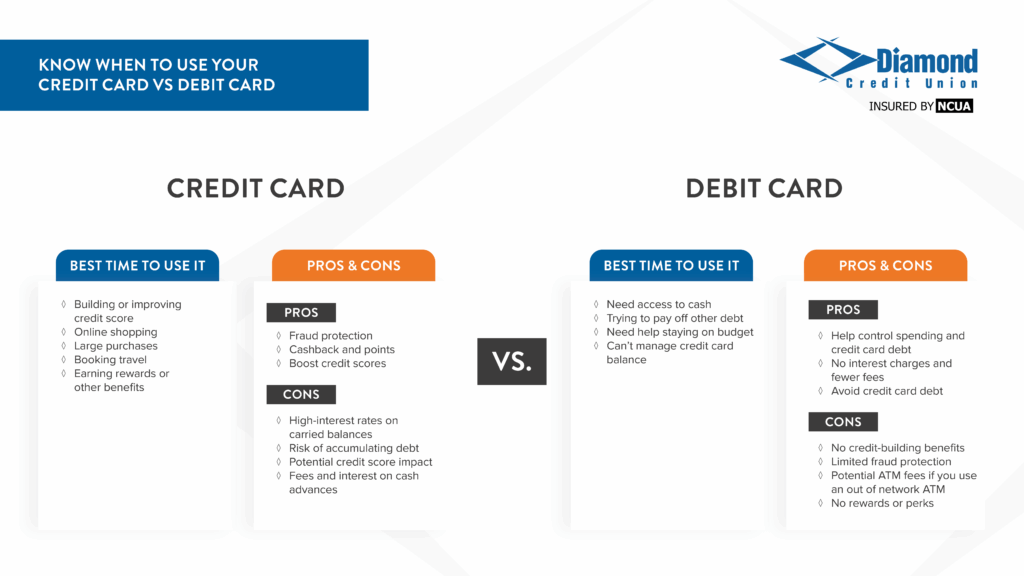

So next time you’re faced with the question, “Debit vs. credit?” consider the benefits of debit and credit cards to determine the best payment options for you.

When To Use a Debit Card

In 2024, debit cards accounted for around 30% of consumer payments made, becoming the second most popular method of payment. There are several scenarios where the advantages of a debit card outweigh using credit cards.

Small Daily Purchases

As society becomes more digital, using a debit card for small purchases, such as your daily coffee run, may be easier because they typically come with lower merchant fees (more on those below). Some retailers may even refuse to accept credit cards for purchases under $10, making the debit card the only digital payment method available.

To Avoid Overdrawn Accounts and Debt

Debit cards are useful tools for managing a budget because every transaction is immediately withdrawn from the connected checking account. This provides a real-time view of your account balance. You won’t be tempted to go over budget or make impulsive, big-ticket purchases when you know the money will be gone from your account immediately.

To Avoid Merchant Fees

As we mentioned earlier, some small businesses, online retailers, and restaurants will add a surcharge when you use your credit card, but typically exclude debit cards from such fees.

It doesn’t make sense to use a credit card and pay a 3% processing fee just to get 1% or 2% cash back. If debit cards don’t have a processing fee, then it would make more sense to use those over credit cards.

When to Use a Credit Card

On the other hand, credit cards do have benefits. Customers often find that credit cards work best in the following situations.

Large Purchases

Using credit cards for big purchases, such as TVs or laptops, provides shoppers with some additional peace of mind since most include purchase protection, a benefit often missing from debit cards. This feature generally makes it easier for customers to return merchandise and get a refund if they’re unsatisfied. Then money isn’t tied up in a checking account, where it might be needed for other purchases.

Online Shopping

Using credit cards for online purchases offers some benefits, such as enhanced purchase protection and fraud coverage. Since thieves can only charge the credit account, you’re generally protected, as the funds are usually reimbursed once the fraud is investigated.

Debit cards usually don’t offer the same level of security. If it gets compromised online, thieves could drain your linked account in minutes, and then it could take days to resolve the issue. This means you’re unable to access the missing cash while the matter is being resolved.

Travel

While traveling can be a rewarding experience, it comes with some risks, and you might wonder if it is better to use credit or debit when traveling. A credit card grants additional protection, especially if that card is lost or stolen. With credit card rewards, it’s also easy to earn cash back on airfare, hotels, and dining out.

However, if your credit card charges a foreign transaction fee, consider using a debit card for international purchases instead. Always double-check which fee is lower before you travel abroad.

Building Credit

Credit cards help you build your credit score, which can help your future. If you have plans for home ownership, your credit score is going to play an important role in applying for a mortgage. Responsible credit card use and a history of paying your credit card bills on time and in full will help improve your credit score. And a higher credit score can equal lower interest rates.

When you learn how to build credit effectively, you lay the foundation for securing better financial terms.

Analyzing Fees, Rewards, and Protections

The best way to know which card is right for you is to understand what each offers. No two debit cards are exactly alike, and each credit card has a range of benefits unique to that card. It’s important to read the terms of each contract to understand the full details.

Understanding Fees: Annual, Transaction, and Overdraft

While debit cards can have lower fees, they aren’t completely fee-free. Things to ask about before getting one include:

- Overdraft fees.

- Non-network ATM fees.

- Foreign transaction fees.

Credit cards may have many more fees, including:

- Annual fees.

- Balance transfer fees.

- Interest charges.

- Late payment fees.

- Over-limit fees.

- Returned payment fees.

- Cash advance fees/ATM fees.

- Foreign transaction fees.

Credit cards may waive some of these fees for a limited time, usually to entice consumers to try them out. You’ll have to read the full terms of service to see what fees apply after your introductory offer ends.

Comparing Rewards: Cash Back, Points, and Perks

While debit cards haven’t traditionally offered rewards, times are changing. Some now pay a small percentage of purchases like fuel or groceries. However, credit cards generally offer more attractive cash back and points-based offers. They can pay up to 5% back on purchases and offer additional bonuses like a statement credit for streaming services or preferred technology providers.

Finding the best credit card rewards for your life and spending can take research. When making your decisions, be sure to factor in the cost of financing. The interest you accrue on balances carried over is almost always more than the value of any rewards you earn.

Working with the Right Financial Partner

Deciding between credit card vs debit cards can be confusing and, with so many options, overwhelming. Finding a financial partner like Diamond Credit Union can help you select the right card for your spending. Contact our team to see if a credit card vs debit card is best for you.