How To Guard Against And Respond To Child Identity Theft

Child identity theft happens. What does that mean for your child? Imagine this scenario: Your college-bound child applies for a car loan or credit card, but is turned down because of thousands of dollars in unpaid debt. Identity theft has struck again, and the resulting poor credit record will affect your child’s financial well-being for years.

Identity theft claims more than 15 million people in the United States, but it’s not just a problem for adults. Roughly 4 percent of identity theft complaints are filed by people age 19 and younger. Still, the numbers don’t tell the whole story. Many incidents of child identity theft aren’t reported because victims are unaware that it has happened.

Why your child’s SSN is as good as gold

When identity thieves get their hands on a child’s Social Security Number (SSN), they have a clean credit file at their disposal that is unmonitored for years. That makes for a very easy and lucrative target for taking out car or property loans, setting up utility accounts, opening credit cards and more. In fact, one study found that identity thieves are 51 times more likely to steal the identity of a child versus an adult in the same population in the same period.

Protect your kids by being proactive

Awareness and vigilance is key to protecting your children from identity theft. Follow these three tips:

- Guard personally identifying information (PII) – Closely protect your child’s SSN and other PII.

• Do ask why people need your child’s SSN and how they will protect it.

• Do shred anything containing your child’s personal information with a cross shredder.

• Don’t carry your child’s Social Security card or number (keep them in a secure place). - Teach good practices – Discourage your child from sharing PII online or in other settings.

- Monitor – Regularly check your child’s social networking sites for signs of PII-sharing. Also, set a reminder to check to see if a credit report has been opened for your child.

Signs of trouble

Aside from checking to see if a credit report has been opened for your child, keep an eye out for other signs of identity theft. For example:

• Government benefits rejections or notices associated with your child’s SSN

• IRS notices about taxes related to your child’s SSN

• Unexpected bills or collections calls

Responding to theft

If you determine your child is a victim of identity theft, it’s important to move quickly to place fraud alerts on credit files with the various credit reporting agencies and begin the process of getting their records cleared.

Diamond members can contact any branch for more information or assistance in connecting with CyberScout’s Resolution Center.

MORE ON IDENTITY THEFT PROTECTION

1 “Consumer Sentinel Network Data Book,” Federal Trade Commission, March 2017.

2 “Child Identity Theft,” Carnegie Mellon CyLab, 2011.

3 “Child Identity Theft,” Federal Trade Commission, 2017, https://www.consumer.ftc.gov/articles/0040-child-identity-theft#Warning.

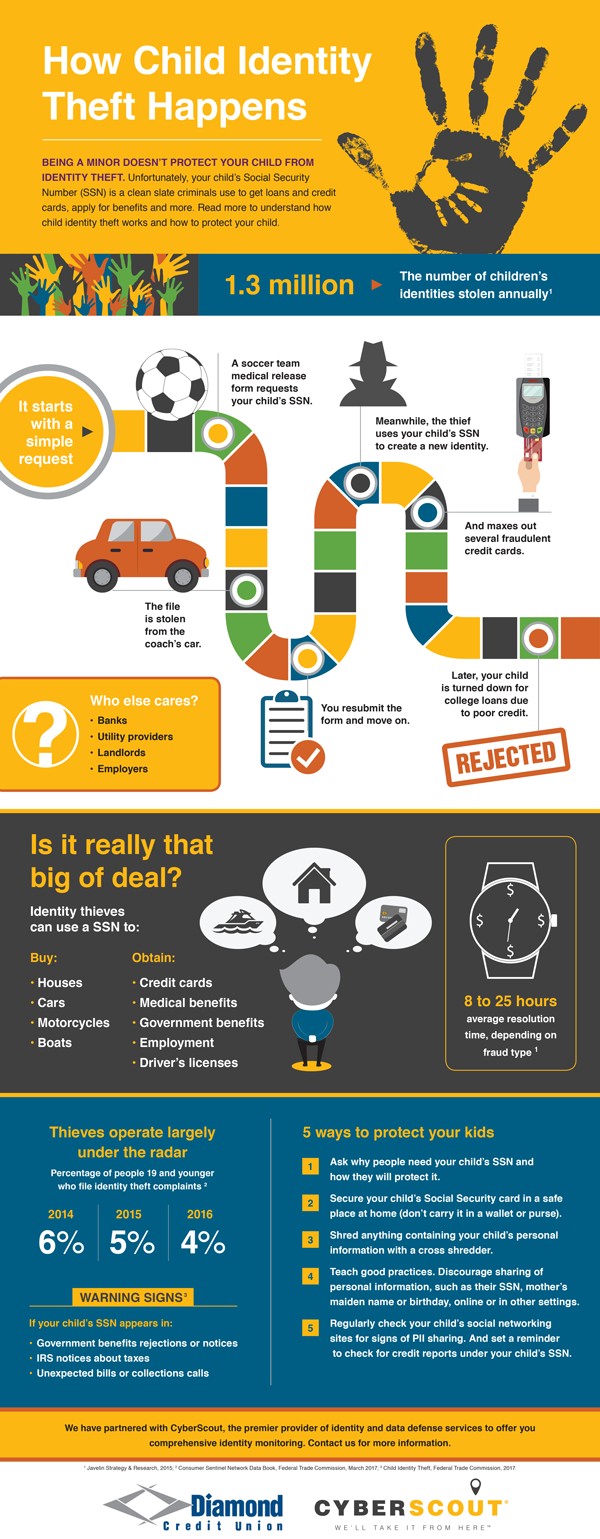

This Child Identity Theft infographic illustrates how child identity theft happens and what to do if it happens to your child.